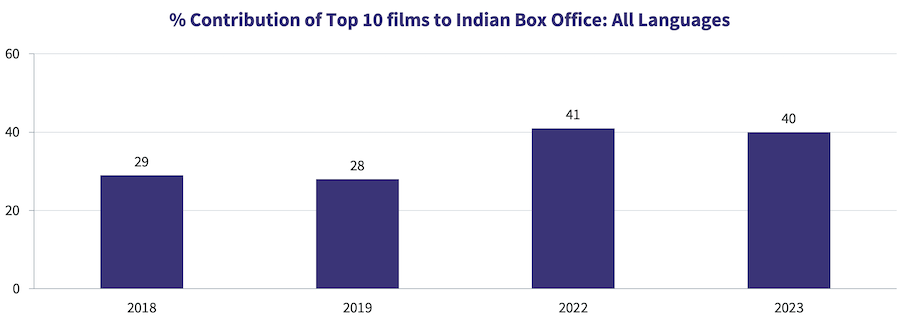

Over the last two years, it is evident that the pandemic has had a significant impact on the theatrical audience’s perceptions and preferences regarding watching movies on the big screen, across India. To delve deeper into this phenomenon, we had conducted this analysis in May 2023, on the percentage contribution of the top 10 films to Indian box office, in pre and post-pandemic scenarios. It was clear that the bigger films were getting bigger in a post-pandemic world, with the top 10 films in 2022 contributing 41% of the Indian box office in 2022 (compared to 28-29% in the pre-pandemic years). 2023 is now over, and it's a good time to examine if 2022 was an aberration in this regard, or does 2023 take the trend of big films getting bigger forward.

To answer this question, the same analysis was performed again on films released in 2023. The chart below highlights the percentage contribution of the top 10 films to the Indian box office (see our 2023 box office report for the film list). 2018 and 2019 represent the pre-pandemic years, while 2022 and 2023 are representative of the post-pandemic scenario.

Of the ₹12,226 Cr gross box office in 2023, 40% (i.e., ₹4,869 Cr) came from the top 10 films of the year. This clearly establishes that the trend of big films contributing a significant portion to the box office, compared to pre-pandemic, is a phenomenon that is here to stay.

Over the last two decades, the global box office has seen top films, belonging to franchises, or featuring imaginative concepts that deliver a noteworthy cinematic experience, reigning supreme. Interestingly, the pandemic has accelerated the establishment of this trend in India. In a post-pandemic world, ideas of scale, action, spectacle, and compelling single-protagonist stories are defining the theatrical experience, as is evident from the top 10 list in our 2023 report linked above.

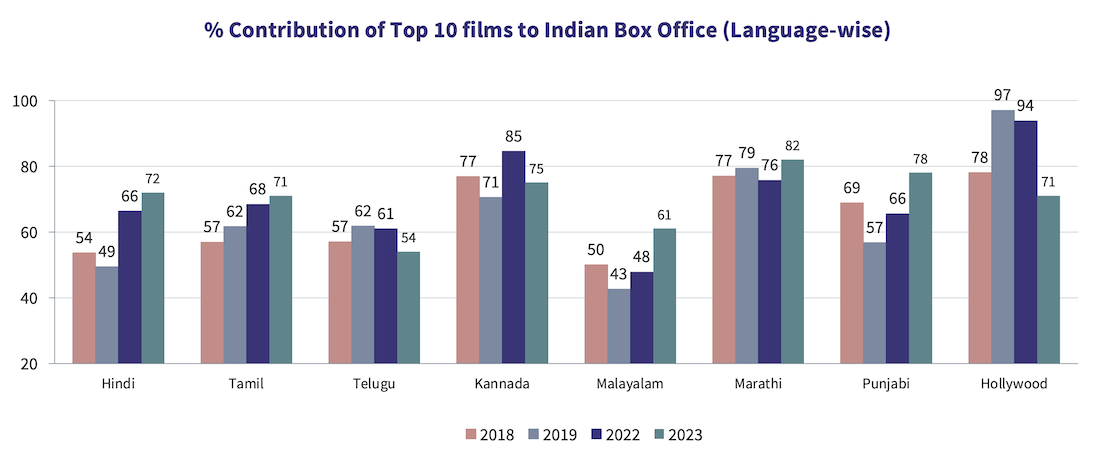

How does this phenomenon play out for different languages? The chart below captures the contribution of top 10 films to the Indian box office for key languages.

In our 2023 box office report, it can be seen that the Hindi and the Punjabi film industries have shown the maximum growth in gross box office in 2023 vs. 2022, at 53% and 60% respectively. Interestingly, these are also the two languages (apart from Malayalam) to show a sizeable growth in the contribution of the top 10 films. In Hindi, this share touches 72%, which in an all-time high. Four films, i.e., Jawan, Animal, Pathaan, and Gadar 2, alone contributed 49% to the Hindi box office in 2023, emerging as the top four Hindi films of all time. Each of these films crossed the ₹600 Cr gross mark, creating a new benchmark for success. In Punjabi, Carry On Jatta 3 grossed ₹54 Cr, becoming the top-grossing Punjabi film of all time, and contributing 23% of the year's Punjabi box office in India single-handedly.

If an increase in contribution of the top 10 films, and a decrease in contribution of the long-tail, results in box office growth, it should be seen as a step in the right direction.

In contrast to the Hindi and Punjabi trend, industries that remained stagnant or saw marginal growth (i.e., Hollywood and Telugu), or declined (i.e., Kannada) in 2023, witnessed a reduction in contribution of the top 10 films to their respective box office collections. Hollywood had more releases in 2023 vs. 2022, leading to more films in the long tail, after a pandemic-induced go-slow in 2022. But the Kannada numbers tell a story of their own, whereby absence of blockbusters led to a free fall at the box office in 2023. Read this analysis, by Sanket Kulkarni and Rohan Babu, on the challenges faced by Kannada cinema in 2023.

While the differences across languages, and across years, will continue to exist, it is evident that the phenomenon of big films getting bigger, and smaller films finding it difficult to find an audience in theatres, is definitely here to stay. ‘Non-event’ films will struggle to collect significantly at the box office, unless they receive extreme audience love, like the recent Hindi release 12th Fail did. Cinema fanatics will argue that this limits the viability of small films that offer stronger content than the crowd-pleasing action blockbusters. But we live in times of streaming, and many such films can find a life of their own in that medium. Whether we like it or not, that's what the audience who pay for tickets seem to have decided!

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy