By Our Insights Desk

Despite being a flourishing market, valued at about $15 Billion, sports entertainment in India does not have too much primary research data in the public domain, except TV viewership estimates. In a deeply heterogeneous country where digital consumption has grown manifold in the last five years, an understanding of Indian sports audience market is important for various stakeholders (associations, league & team owners, broadcasters & advertisers), to enable them to take sound business decisions in an expensive category.

The Ormax Sports Audience Report: 2024 intends to plug the data gaps that exist in this domain, through a first-of-its-kind, large-sample primary research. The report is based on India’s largest sports research, conducted between Nov 2023 and Jan 2024, among 12,000 audiences across urban and rural India. The report covers 21 sports, 53 sports tournaments, and 52 clubs & franchises, apart from several aspects related to sports viewing behaviour of Indian audiences.

Sizing India's Sports Audience Universe

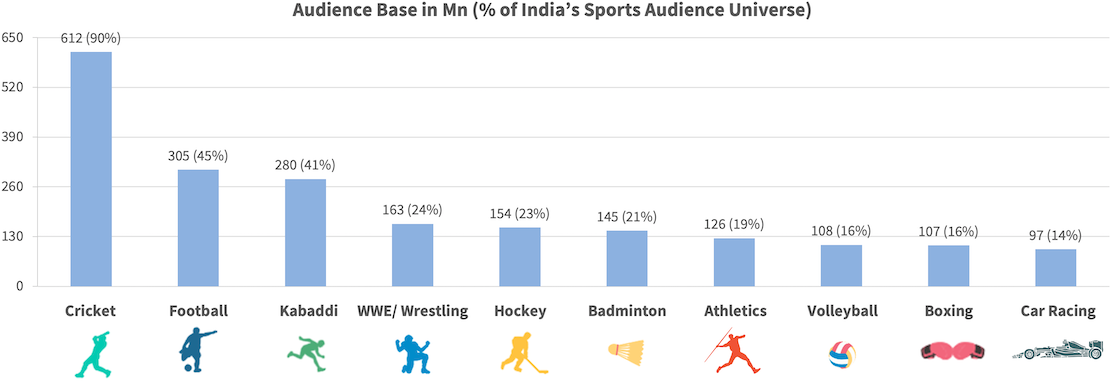

In this report, 'Sports Audience’ is defined as someone who watched sports content on TV or OTT in the last one year for at least 30 mins. As per the report, India’s estimated sports audience base is a staggering 678 million (67.8 crore). Cricket, Football & Kabaddi are the top 3 sports, with audience base of 612, 305 & 280 million respectively.

The report sizes and profiles the sports audience universe by demographic & market variables, such as gender, age, NCCS, pop strata, and states. Audiences of each sport have been segmented into three categories - Heavy, Medium & Light - based on their frequency and time spent on that sport in the last one year.

The report goes on to take a deeper look at various sporting tournaments & leagues, franchises, sports stars, as well as other consumption context related aspects like viewing behavior, preference of commentary, etc.

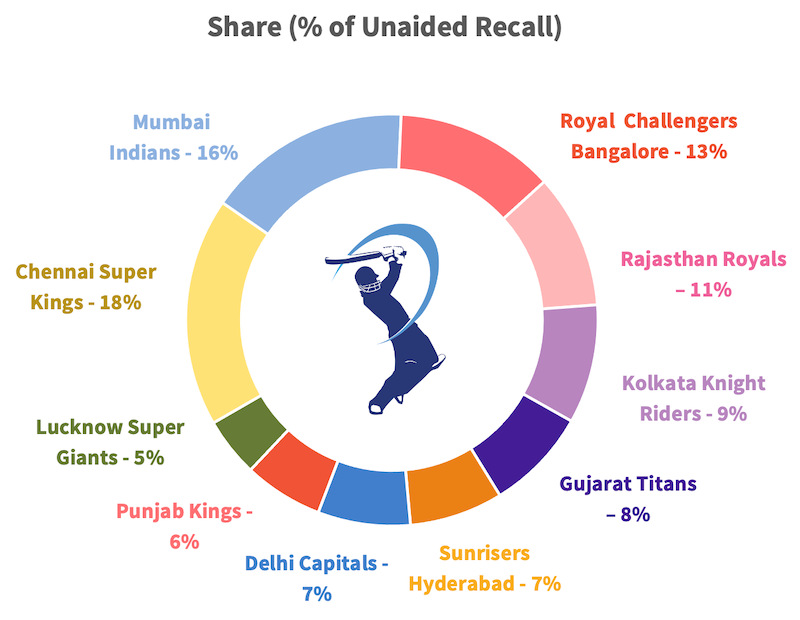

Sports Franchises

Among various IPL franchises, Mumbai Indians and Royal Challengers Bangalore take the second and third spots, after Chennai Super Kings.

Among the other top sports, i.e., Football and Kabaddi, Manchester United and Patna Pirates are the most-recalled franchises, respectively.

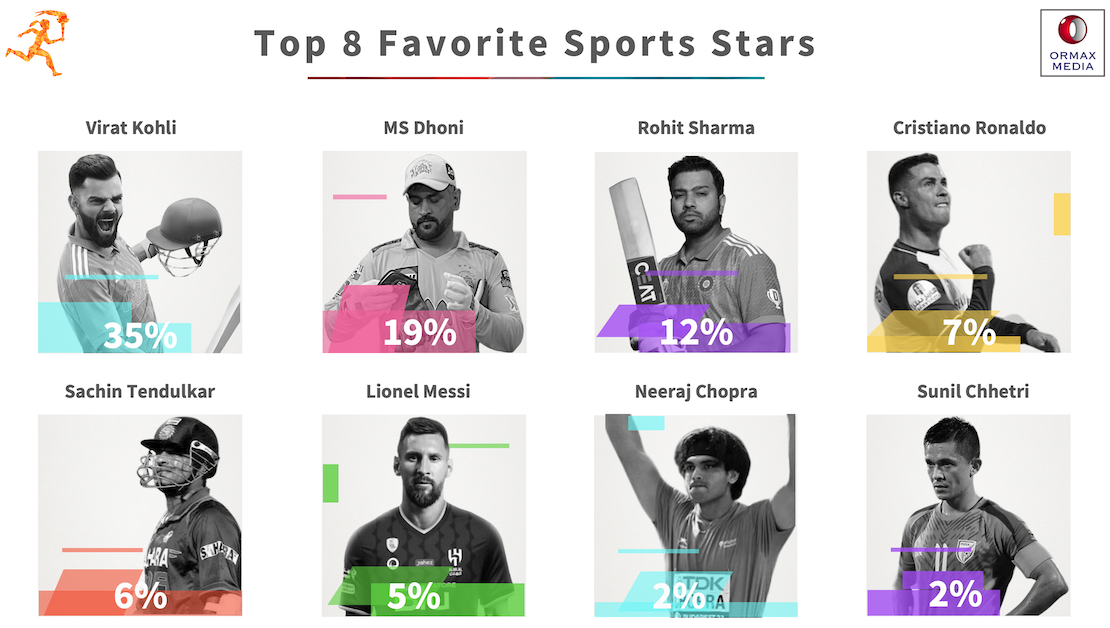

Favourite Sports Stars

Virat Kohli is the most popular sportsperson in India, while MS Dhoni is ranked no. 2, despite having retired from international cricket.

To subscribe to The Ormax Sports Audience Report: 2024, please drop in an email to [email protected], and we will connect with you soon.

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Streaming has a new bias: The male lead

An analysis of 338 Hindi fiction originals since 2022 highlights a growing imbalance in the Indian streaming ecosystem, with male-led stories steadily taking over

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy