OOH (Out-of-Home) advertising is probably the earliest form of advertising. From nailed or glued posters on electric poles or trees, to formal wall mounts, to large-format billboards and displays, the medium has grown over the years, both in terms of value and the options available for reaching more eyeballs.

The 2020 edition of the FICCI Media & Entertainment report projects that the OOH sector will grow at 5.5% CAGR, to about ₹ 46 billion by 2022. Digitization, and the value it brings for the advertiser, is expected to be a key propellant of this growth. The report also projected that DOOH (Digital OOH) will be one of the fastest-growing media in the country, in turn driving the overall growth of OOH sector. The growth of DOOH will also present an opportunity to address three areas currently missing in OOH advertising:

1. Continuous measurement-based planning

2. Programmatic advertising based on TG

3. Media buying based on audience impressions

The ongoing modernization of airports and railway stations, and the addition of new metros and malls, will exponentially increase the overall DOOH inventory in India, bringing various options for size, context and format into play. But the key to DOOH's growth will be the industry's ability to be able to measure this media on its reach and deliveries. And no, simplistic data such as footfall or ticket sales, will not be enough.

Additionally, integration of DOOH in omni-channel media plans and 360° campaigns will form the strategic foundation for this growth. This will also be a first for the Indian OOH industry, which has typically been kept out of the media plans due to the absence of continuously-measured audience reach and efficiency data.

To be on the top of this growth wave, DOOH networks need to be audience aware, to enable their advertisers achieve targeted reach and engagement from the medium. This has been a persistent demand by advertisers and media planners for a while. Absence of audience data of this quality makes it difficult for them to justify their investments in the medium. Providing rich audience data will enable three things for a DOOH owner:

1. Inclusion of DOOH in above-the-line media plans and omni-channel campaigns

2. Programmatic targeting and playout based on actual audiences in front of the screen

3. Credibility of the effectiveness of the campaigns

Compared to Television and Print, programmatic playout is the key differentiator for DOOH. Television and Print offer targeted reach, but do not possess the capability to play out creatives in line with the target group consuming the media at a particular point of time. With the right intervention of technology, DOOH possesses this unique and powerful capability.

Digital videos on the Internet offer this capability, and it's one of the reasons why Digital media enjoys a huge share of AdEx in India. Advanced audience analytics and programmatic targeting capabilities convince the advertisers that they can spend their marketing budgets in a manner that's precise and less wasteful. But Digital comes with its share of limitations too. The idea of '1 playout = 1 set of eyeballs', various format compliances, ad blockers and impressions harvesting farms... such issues are now beginning to come up as growing doubts. But the more conceptual issue with Internet advertising is that, by its very nature, it is intrusive, like most advertising. And as the SVOD audience base grows in India, a section of premium customers may be out of reach of traditional digital advertising, and may have to be targeted through other methods, such as branded content, on the Internet.

DOOH is free from such issues. By its very nature, the medium is unobtrusive, which implies higher audience engagement and attention time. And the equation '1 playout = multiple eyeballs' offers an efficient means for wider message delivery. As a result, DOOH advertising has emerged as a dominant media option globally. Let's look at a case study.

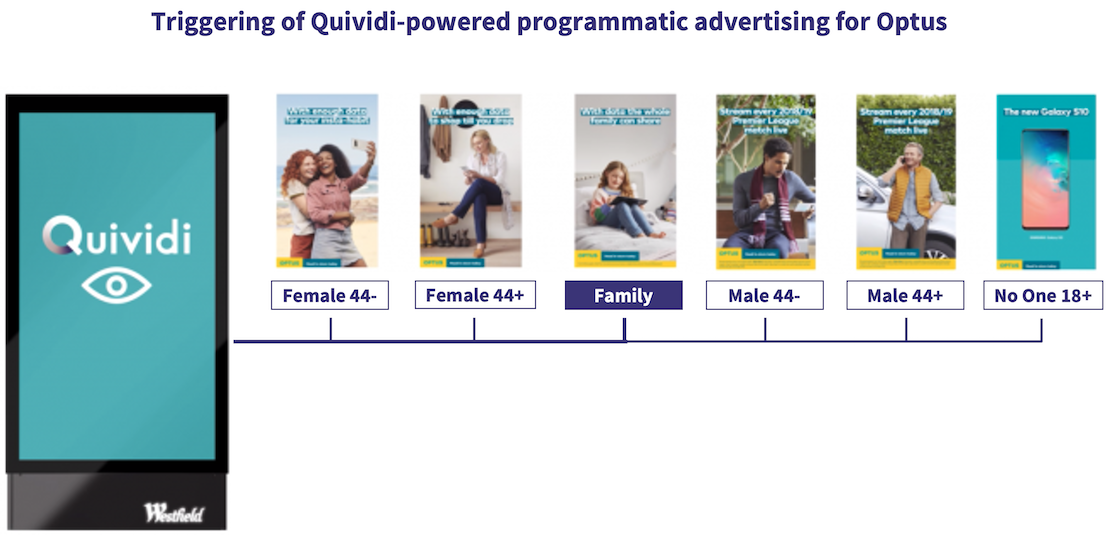

In Australia, for the launch of Samsung S10, Australia's second-largest telecommunications group Optus ran a test campaign across screens that were enabled (and not enabled) with audience analytics and programmatic playout technologies, in association with Brandspace and Quividi.

Brandspace owns and operates the SmartScreen network, a media portfolio of thousands of screens located in 41 Westfield Living centers spread across Australia and New Zealand.

Quividi is the world's no. 1 audience & campaign intelligence platform for Digital OOH, with 600+ customers across 80 countries, analyzing billions of audiences every month, across tens of thousands of screens. Quividi powers up Digital Signage and Digital Out-of-Home into a potent medium for brands, boosting engagement, traffic and sales. With the Quividi platform, marketers have the unique ability to test, measure, optimize and deliver data-driven contextualized content to best engage and convert audiences, while respecting privacy.

The Optus campaign ran for four weeks, with an objective to target the desired audience profile, cut through the noise in busy environments, and drive more engagement & sales. The campaign designed was tailored to target various target groups (men, women, youth, mature, etc) with apt creatives and messaging.

Based on Quividi’s audience detection technology and TG-specific triggering mechanism, the screens played out creatives with relevant messaging based on the profile of the audience viewing the screen. To understand the efficiencies, 20 locations were enabled with 10 screens playing a generic loop and the other 10 screens playing out ads based on Quividi’s audience analytics and targeting.

The results were stark. Targeted messages had 65% more watchers per play compared to the network benchmark. Targeted messages yielded a 29% uplift in the average attention time from the target audience compared to the generic loop. In effect, targeted messages were 32% more efficient at reaching the target audience.

Besides offering an efficiently run and validated campaign, the system also highlighted several other aspects of media assets in terms of reach, engagement potential, placement and orientation. This further helped craft optimal creative executions and messaging based on the engagement and position of the screen.

In India, Ormax OHM (Out-of-Home Measurement), launched in 2019, has run measurements using Quividi’s technology at various locations, with 10,000+ OTS, with 7,500 audience (75% cut-through) profiled by gender, age & mood, 1.5 million seconds of dwell time. In these measurements, the average session length was two minutes per audience, i.e., eight creatives of 15 seconds each, translating into eight impressions per audience!

Advertisers demand opportunities to engage with audiences. For example, streaming platforms, one of the largest spenders on DOOH media, would want to utilize audience analytics to target the relevant TG with the right content proposition. And the need will not be very different for sectors like FMCG, Retail and Realty, which currently have to work with a ‘one creative that fits all' approach.

Audience analytics and programmatic advertising are set to propel the growth of DOOH. Ormax OHM has partnered with Quividi to offer the technology for advanced audience analytics and programmatic automation in India. The data is collected in real-time, and measured 24x7 with 100% enumeration, using technology that works completely in the background, across ambient media assets being measured. This data offers an inherent assurance to advertisers that their investments are delivering efficiently on the business objectives.

Know more about Ormax OHM here. Reach out to us for a demo or trial.

Product launch: Ormax Sports Track

Our new syndicated tracker, Ormax Sports Track, measures awareness and engagement with sports tournaments among India’s digital audience

Ormax Mpact case study: Realme Hip Hop India 2 on Amazon MX Player

Did brand Realme benefit from its sponsorship of Hip Hop India 2 on Amazon MX Player? Read this Ormax Mpact case study to find out

Ormax Mpact case study: Mountain Dew ft. Salman Khan & Hrithik Roshan

This case study, for the new Mountain Dew commercial launched during ICC Champions Trophy 2025, showcases our Brand Lift measurement tool Ormax Mpact

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy