By Our Insights Desk

Compared to theatrical content, streaming is often perceived as a more gender-balanced space, offering greater room for female-led narratives. While titles like Delhi Crime and Aarya reinforce this belief, how accurate is this perception when we look at the broader universe of Hindi fiction on streaming in India? It’s time to examine the data.

The Methodology

A total of 338 Hindi fiction originals on streaming (series and direct-to-OTT films released since January 1, 2022, with an estimated viewership of at least 5 million in India, were analysed for the gender of their protagonist. Each title was classified as Male, Female, or Shared, based on the fundamental question: “Whose story is this show or film about?” While the question may appear subjective at first glance, most properties offer a clear answer. For those that don’t, Ormax Media’s story-analysis frameworks provide a consistent and objective basis for classification.

The Results

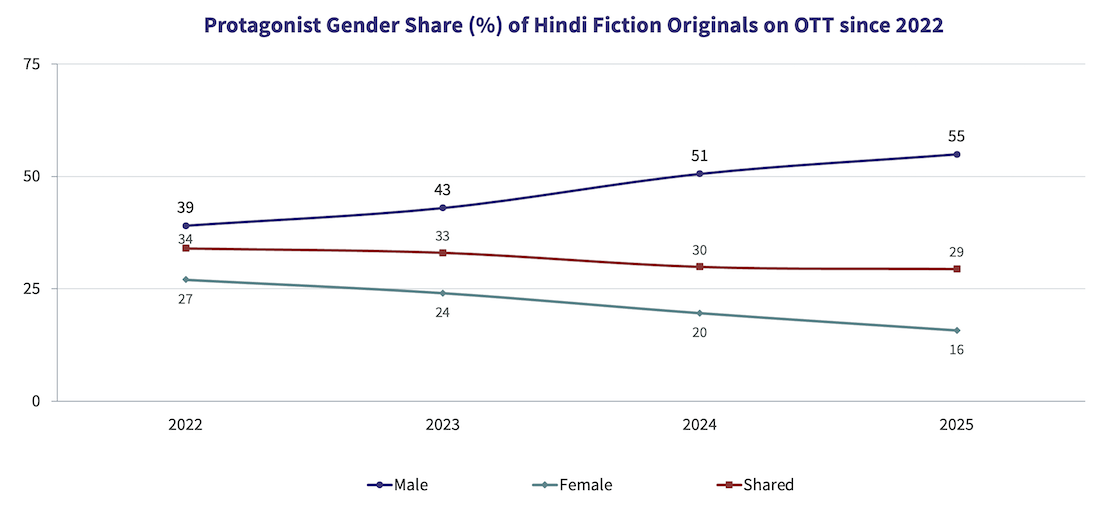

The chart below captures the year-on-year movement on the protagonist’s gender of Hindi streaming originals (fiction) in India.

As the data indicates, not only is the share of male protagonists significantly higher, the skew has intensified over time. The rise in male-led content has come largely at the cost of female-led stories, while the proportion of ‘Shared’ protagonists has remained relatively stable. The male-to-female protagonist ratio has increased sharply - from 1.4x in 2022 to a markedly disproportionate 3.5x today. Put simply, for every two Hindi fiction originals anchored by a woman, there are now seven centered around a man.

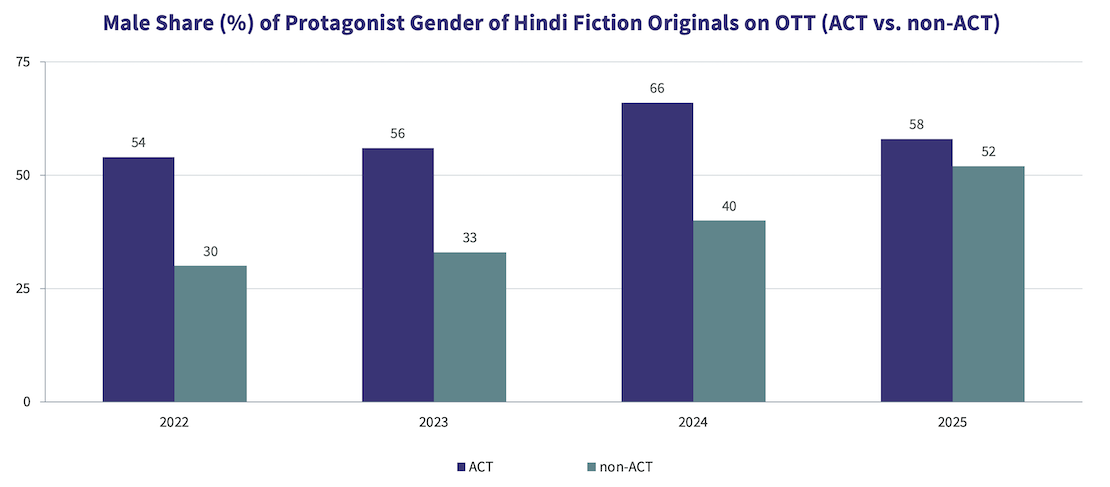

About 43% of Hindi fiction originals on OTT fall within the ACT (Action Crime Thriller) genre cluster, with Human Drama (26%), Feel Good (20%), and Gen Z (11%) making up the remainder. These proportions have stayed broadly consistent since 2022, with minimal year-on-year variation. Within the ACT cluster, protagonist gender has been consistently male-skewed across all years. What’s more striking, however, is the shift outside the ACT space. The share of male-led titles in non-ACT genres has risen sharply - from 30% in 2022 to 52% in 2025. With ‘Shared’ narratives accounting for much of the rest, the decline in female-led properties is correspondingly steep, dropping from 31% in 2022 to just 12% in 2025.

The rising skew, therefore, isn’t driven by an increase in ACT content alone. The sharper shift is occurring within Human Drama, Feel Good, and Gen Z narratives, which are becoming progressively more male-led. It’s this shift in non-ACT genres that is driving the marginalization of female protagonists.

The Implications

OTT platforms commissioning a higher volume of male-led titles across content clusters appears to stem from a tendency to chase short-term signals, specifically the belief that male audiences offer stronger subscription and advertising potential than female audiences.

Even if one grants some merit to this line of thinking, it remains contentious for at least three reasons:

1. Female audiences represent significant headroom for growth in both paid and free streaming markets in India. Marginalizing them risks stagnation in both viewership and subscriptions, particularly in households where the subscription may be paid for by the man, but the decision to subscribe is often a shared, family-level one.

2. An over-reliance on male-led narratives has contributed to greater homogenization of content. This is counterproductive for long-form streaming originals, which compete not just with each other but with a vast universe of alternatives - theatrical releases, sports, social media, YouTube, and even micro-dramas.

3. With Connected TV (CTV) adoption growing rapidly (see numbers here), co-viewing will increasingly compete with solo viewing - a trend outlined in this analysis published a year ago, when CTV was still in its early growth phase. A male-skewed programming lens risks being misaligned with this shift, which calls for more gender and age-inclusive storytelling.

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy