By Our Insights Desk

We started publishing The Ormax OTT Audience Report from 2021. The annual report is our endeavour to size the growing Indian OTT (digital video) market using primary research, than rely purely on secondary data, proxy variables (like Internet and smartphone penetration) and industry estimates.

The third edition, titled The Ormax OTT Audience Report: 2023, is based on data collected from 12,000 respondents across India in Jul-Sep 2023, is now out, and available for subscription (see details at the end of this article). As per the report, India's OTT audience universe, defined as those who have watched digital videos at least once in the last one month, is now at 481.1 Million (or 48.11 Crore) people. The growth from 2022 to 2023 is in double digits at 13.5%, but much lower than the growth from 2021 to 2022, which stood at a healthy 20.0%. India's OTT penetration now stands at 34% of the country's population, up from 30% last year.

The full report highlights how the growth this year has been driven by NCCS CDE, small towns and rural India, while NCCS AB and metros, as well as some of the mini metros, are beginning to either reach saturation, or slowing down considerably, witnessing single-digit growth in percentage terms.

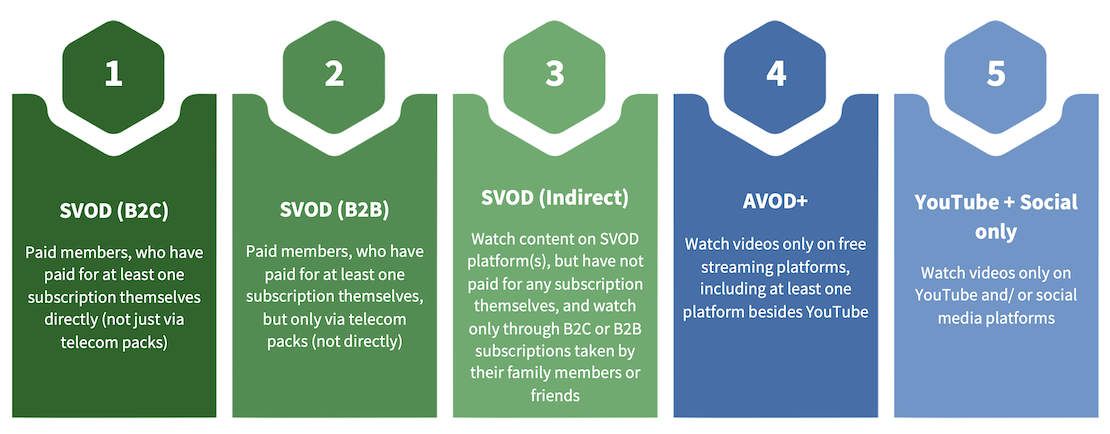

The report divides the 481.1 Million universe into five segments, defined in the chart below, based on free vs. paid usage.

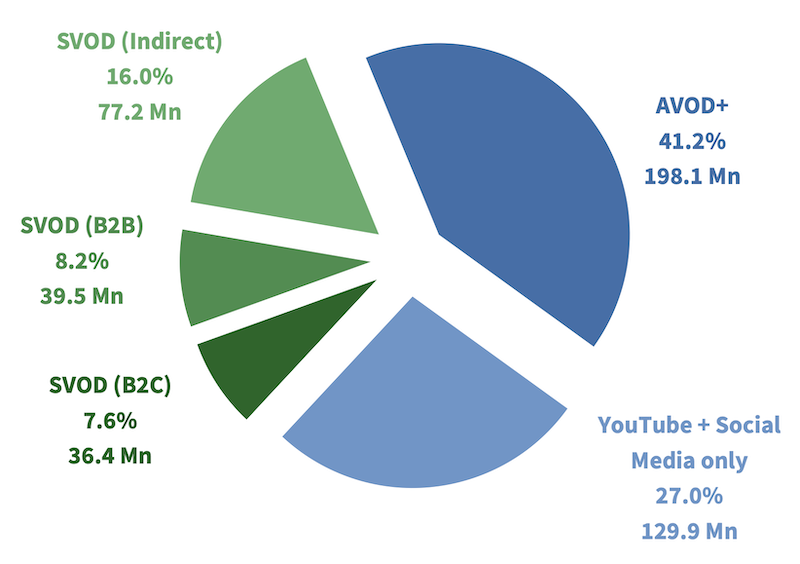

The size of the five segments can be seen in the chart below. SVOD audiences, who have access to paid content, comprise of 153.0 Million people, i.e., 31.8% of India's OTT universe. The remaining 68.2% (328.1 Mn) are accessing only free content, and a sizeable section out of these are watching videos only on YouTube and social media apps.

The SVOD (B2C) segment averages at 2.8 subscriptions per user, leading to a total of 101.8 Million direct-to-consumer paid subscriptions in India.

To know more about the report, read the details here.

Read the press coverage of the report in Mint, afaqs!, and Financial Express.

To subscribe to The Ormax OTT Audience (Sizing) Report: 2023 please drop in an email to [email protected], and we will connect with you soon.

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Streaming has a new bias: The male lead

An analysis of 338 Hindi fiction originals since 2022 highlights a growing imbalance in the Indian streaming ecosystem, with male-led stories steadily taking over

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy