By Our Insights Desk

Our mid-year report, Top 50 Streaming Originals in India: Jan-Jun 2025, was released earlier this month (read and download here). Among the many fascinating insights it offers, one that stands out is the growing marginalization of the direct-to-OTT film format - once seen as a key pillar of India’s streaming content landscape.

Of the 50 most-watched streaming originals in India in the first half of 2025, only five are films - a mere 10%. In contrast, the list features as many as 40 fiction series, while the remaining five spots go to reality shows, a genre that has always been more of a variety feature than a mainstay on streaming. In effect, direct-to-OTT films are now as marginal a presence as reality shows in the high-viewership bracket.

The imbalance is starker when viewed against supply. While direct-to-OTT films account for only 10% of the Top 50, their supply share is nearly double. Between 2022 and 2024, 19% of all streaming originals were direct-to-OTT films - a trend that held steady in the first half of 2025 as well. As many as 30 such films released between January and June this year: 21 in Hindi, eight in Telugu, and one in Tamil. Yet only five - four Hindi and one Tamil - made it to the Top 50.

Clearly, the ROI is underwhelming. This marginalization is evident in Ormax Stream Track (OST) data as well. OST tracks upcoming and recently-launched streaming originals on four key audience parameters: Buzz, Reach, Appeal, and Potency. Buzz refers to unaided recall, and is a strong indicator of the talk value of the property. Reach refers to awareness of the property, while Appeal is a measure of the definitive intention to sample the property upon its release. Potency is a measure of the ability of the property to generate new paid subscriptions.

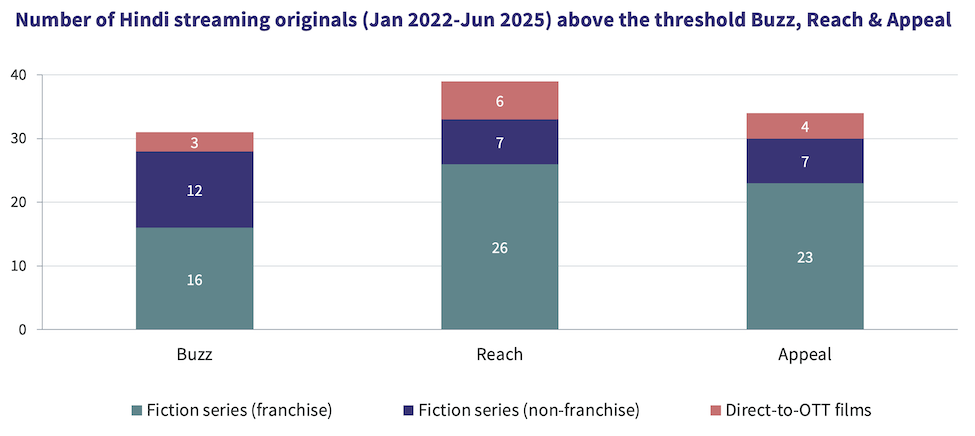

For this analysis, the threshold levels have been set at 20% Buzz, 80% Reach, and 50% Appeal. Properties that manage to cross these thresholds form an elite club of shows and films that stand out in the streaming clutter.

The chart below captures the number of Hindi streaming originals (released between Jan 2022 and Jun 2025) that achieved these thresholds in at least one week of their campaign. Potency has been not considered for this analysis, as the parameter was introduced only in mid-2024.

Once again, direct-to-OTT films trail, contributing only 10% share on Buzz, 15% share on Reach, and 12% share on Appeal.

A marketing challenge

At the heart of the issue is lack of marketability. An analysis on average Ormax Power Rating (OPR) confirms this challenge. OPR, a single point score of a 0-100 scale, is the key performance metric of audience likeability and advocacy, which is used extensively in our content testing work. A higher OPR indicates stronger word-of-mouth, with scores of 60 or above considered indicative of strong engagement and positive advocacy.

Since 2022, the average OPR for direct-to-OTT films has been on par with, and at times even slightly higher than, fiction series on the same platforms. This suggests that those who do watch these films often enjoy them as much as they enjoy web-series. The issue, therefore, isn’t content quality. It’s visibility and positioning.

Unlike web-series, which are clearly differentiated from theatrical films due to their long-form nature, direct-to-OTT films occupy a confusing middle ground, the proverbial 'no man's land'. They offer neither the narrative depth of series nor the grandeur and pop culture value associated with theatrical films.

Even the word “film” (or its synonym “movie”) evokes imagery of a big-screen experience. A direct-to-OTT film, by its very nature, enters the race with a credibility deficit. During the pandemic, many films that made it directly to OTT were originally conceived and produced for a theatrical release. Understandably, the performance of such films may have led to the supply bias we continue to see even in 2025.

It seems unlikely that this format will find renewed favour with audiences in the near future. If platforms continue to push it in the hope of changing viewer habits, they may be fighting a losing battle.

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

Product launch: Ormax StreamView

Our new weekly tracker is designed to answer a simple, high-stakes question for the Indian media and advertising ecosystem: “What is India watching on OTT?”

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy