By Our Insights Desk

Last month, we launched what is by far our most intricate television product in our 13 years history: Ormax Televate. An analytics engine that combines quantitative and qualitative audience data with a strategic perspective on the Indian television sector, Ormax Televate is a tool that helps TV channels identify a viewership growth strategy.

The idea for Ormax Televate comes from a hard-to-miss observation about the Indian television industry: Viewership of a TV channel is a direct determinant of its revenue, and hence, TV channels make various efforts in the areas of content, marketing, branding, distribution, acquisition, etc. to increase their viewership. However, these initiatives are often like hit-and-trial, and a lot of time and resources are spent on projects and activities that may have incremental value at best.

Ormax Televate identifies three priority areas a TV channel must focus on to achieve sizeable viewership growth, and lays out a detailed strategic roadmap for each of them. In effect, it helps the senior management at TV channels cut the clutter and save their valuable time chasing what really matters.

The tool works in two stages. In the first stage, channels get access to strategic brand data for their brand and its competition. This data has been collected by us for 157 pay channels genres and languages, with a total sample size of more than 75,000, and is being updated at a monthly level. This stage helps a channel assess where they stand currently on key brand measures, and what the relationship of the brand with its target audience is. At the end of Stage 1, channels get access to a list of 15 barriers preventing them from garnering higher viewership. These 15 are shortlisted from a list of 172 barriers generated by mining our qualitative research work since 2008. Each barrier has been meta-tagged, and based on how the brand performs on key measures, the Barriers Algorithm selects the barriers most appropriate for the brand.

Stage 2 is then about identifying three priority areas that address these (or most of these) barriers, and about laying out a strategic roadmap for each of the three. This stage involves strategic techniques and tools, such as cause-effect analysis, content assessment framework development and brand architecture development. Stage 2 also involves consumer interventions using qualitative research to progressively test the hypothesis and the action plan being developed over a period of three months.

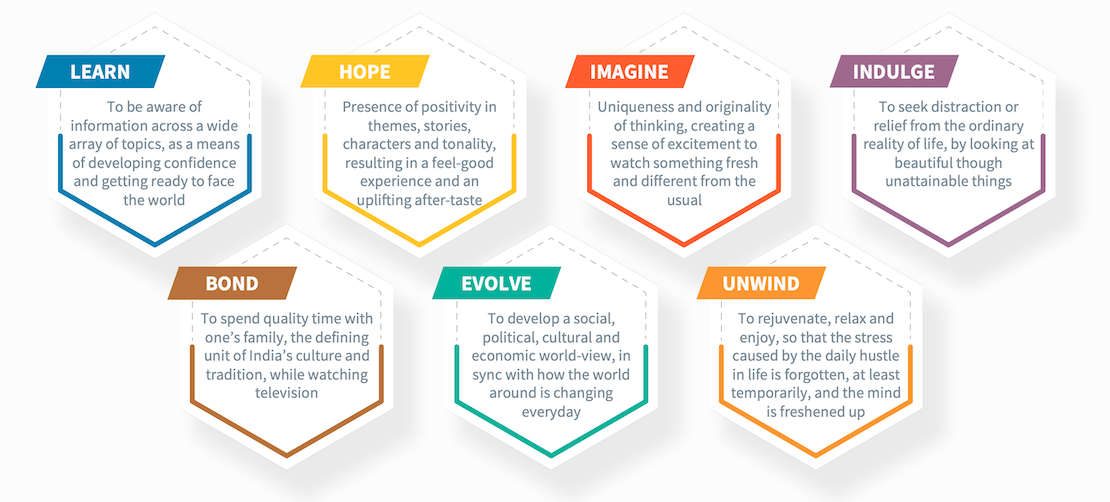

At the heart of Stage 1 of Ormax Televate are seven needs satisfied by television. Ormax Televate’s Seven Needs Model postulates that television is eventually watched for only seven reasons in India. While the relative weights of these seven needs will vary by language and genre, between these seven, all possible reasons for watching a particular genre, program, character, or any other piece of content, can be explained. More than two years of rigorous work has gone into identifying these needs, and we are glad that we can now share them with the Indian TV industry at large.

The chart below captures the seven needs and their one-line definitions.

For the next few weeks, we will post a new piece on this website every Thursday evening, on the relative importance of these needs for various genres and languages in Indian television, including analysis and interpretation from our team of experts. Watch this space!

Venn It Happens: OTT & Linear TV audience intersection

The first edition of our new feature Venn It Happens illustrates the intersection between OTT and Linear TV audiences in India, using data from The Ormax OTT Audience Report: 2025

Not just nostalgia: Why legacy characters are dominating HGECs

Despite not featuring in the show since 2017, Daya (Taarak Mehta Ka Ooltah Chashmah) continues to enjoy immense popularity among Hindi GEC audiences. Her enduring success highlights a category trend

Ormax Mpact case study: Bandhan Mutual Fund on India Today TV

This case study, based on the integration executed by Bandhan Mutual Fund on English news channel India Today, showcases our Brand Lift measurement tool Ormax Mpact

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy