By Sanket Kulkarni, Rohan Babu

The impact of the pandemic, the advent of streaming, and the proposed rise of ‘pan India’ cinema, together have resulted in fundamental changes in the theatrical value chain in the country, across languages, in recent years. Each film industry has had its own unique content and box office journey in these exciting times. Tamil, Telugu and Kannada film industries had a great year in 2022, setting new box office records, and finding audience for their content, including those outside the home states, like never before.

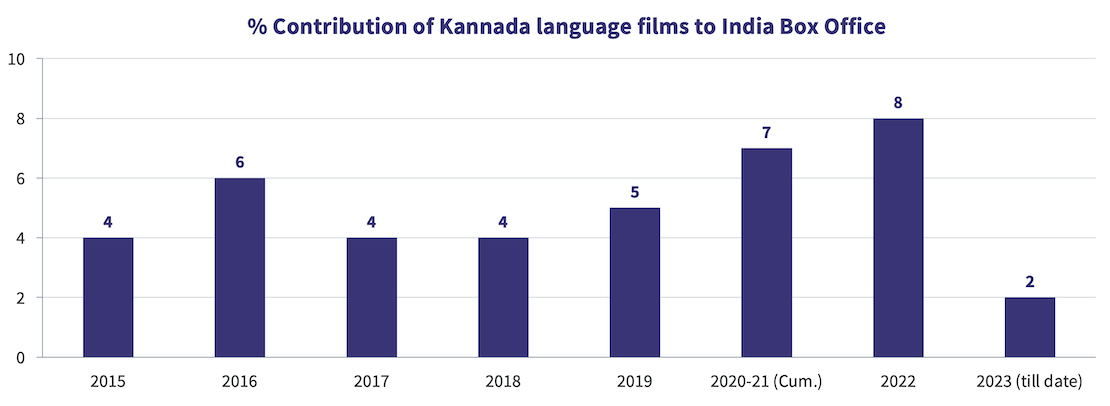

While Tamil and Telugu industries have continued to take the momentum ahead in 2023, the Kannada film industry has struggled to maintain the high it reached in 2022. As can be seen in the chart below, Kannada industry’s share of India box office touched an all-time high of 8% in 2022, but has dropped to a mere 2% in 2023. With no big films scheduled for the rest of the year, the year is likely to end around the 2% mark.

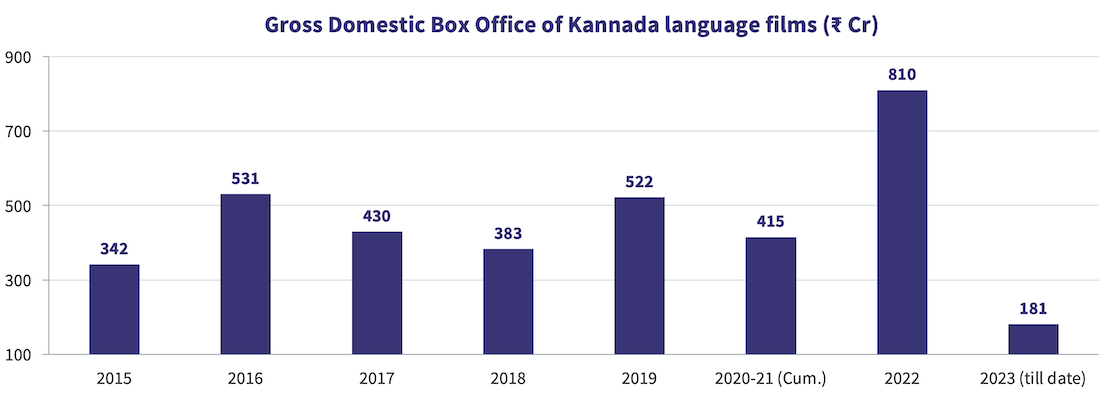

Kannada industry’s drop in share from 8% to 2% also corresponds to a 75%+ drop in the total box office (from 2022 to 2023 till date), as seen in the chart below. Kannada language versions of multi-lingual films are included in these figures, but box office of other language versions of Kannada films (e.g., Hindi versions of K.G.F: Chapter 2 and Kantara) are not included.

Why has the Kannada film industry not been able to deliver in 2023? Let’s dive deeper.

Kannada Cinema: 2022 & 2023

Two of the biggest contributors to Kannada cinema’s success story in 2022 were K.G.F: Chapter 2 and Kantara. However, even after removing the contributions of these two films, the gross box office of Kannada cinema in 2022 stands at a healthy ₹400+ Cr. In contrast, 2023 is below the ₹200 Cr mark currently, and may not cross the ₹200 Cr figure even by the end of the year. Other films that strengthened the 2022 Kannada box office collections were James and Gandhada Gudi (last two films of the late superstar Puneeth Rajkumar), the pan-India attempt Vikrant Rona, an experimental film 777 Charlie, and sequels Gaalipata 2 and Love Mocktail 2.

Of the five Kannada films (K.G.F: Chapter 2, Kantara, K.G.F: Chapter 1, Roberrt, and James) to ever cross the ₹100 Cr gross domestic box office mark, three released in 2022! K.G.F: Chapter 2 & Kantara also went on to become big hits at an all-India level, with 79% and 52% of their all India collections respectively coming from non-Kannada (primarily Hindi) versions.

When one juxtaposes these films with the kind of films that have released in 2023 till now, there seems a clear dearth of films that have the aspiration or the potential to reach the benchmarks set by the top films of 2022. 2023’s highest grosser, Kranti, is a mass entertainer starring one of Kannada industry’s biggest stars, Darshan. However, the scale for the film fades in comparison to K.G.F or Vikrant Rona. Kabzaa, which was touted to be one of the biggest pan-India films this year, ended up being an attempt to make another K.G.F. Both films failed to cross the ₹50 Cr mark across India. Apart from this, the only other big star who had a release in 2023 is Rakshit Shetty. His romantic film Sapta Sagaradaache Ello - Side A has managed to gross only around ₹23 Cr, despite positive reviews.

Here is our analysis of some important factors that are hampering consistency and growth of Kannada cinema at the box office:

1. Lack of culturally-rooted content

The biggest strength of Kantara and K.G.F. Chapter 2 was the unique theatrical experience these films delivered. Both narrated stories that originated in places and cultures that were unique to the state of Karnataka, be it the Bhoota Kola dance in Kantara, or the setting of the Kolar Gold Fields in K.G.F. Owing to the film’s rootedness in the flavors of Karnataka, there was an inherent audience connect with the films' identity as Kannada films - a rarity in Kannada industry. As a result of its very specific rootedness, Kantara (a smaller, non-franchise film) got almost the same number of footfalls in Karnataka than K.G.F. Chapter 2, as it got a bigger reception in south Karnataka, owing to its Tulu dialect (a language spoken in that region).

2. Lack of a definitive cinematic differentiator

Every language industry has its own signature genre and brand of cinema that differentiates it. While Telugu cinema is known for creating family films with hero worship and action set pieces, Tamil cinema popularized films that provide a social message through vigilantes. Malayalam cinema is known for its unique and realistic stories that are rooted in the culture of the state (see this 2021 analysis on the Malayalam film industry). Kannada cinema lacks a definitive cinematic identity of this nature.

There are multiple instances of Kannada blockbuster films being strongly inspired by hits from other languages. K.G.F took strong inspiration from Chiranjeevi and Amitabh Bachchan films. Malayalam film Premam was an inspiration for Kirik Party, which ended up being the highest-grossing Kannada film in 2016.

Many upcoming film trailers or teasers in Kannada cinema have a sense of 'K.G.F déjà vu' in their visual language and dialogues. It indicates the tendency of the industry to milk a genre/theme, till the genre kills itself. A similar phenomenon was observed in Marathi industry post the success of Sairat (see this analysis).

With the lack of a definite cinematic differentiator, and the industry’s tendency to replicate success stories without adding freshness, an original cinema movement is an unrealized idea in the Kannada industry as of today.

3. A multi-lingual market

Potential Kannada hits end up getting limited release (number of screens, multiplex shows, etc.) compared to films of non-Kannada languages releasing on the same day, eventually leading to a smaller first-day collections for Kannada films. In 2023, Telugu films Kushi and Dasara got a much higher first-day box office in Karnataka than Kannada films Sapta Sagaradaache Ello - Side A and Gurudev Hoysala, which starred Rakshit Shetty and Daali Dhananjaya respectively.

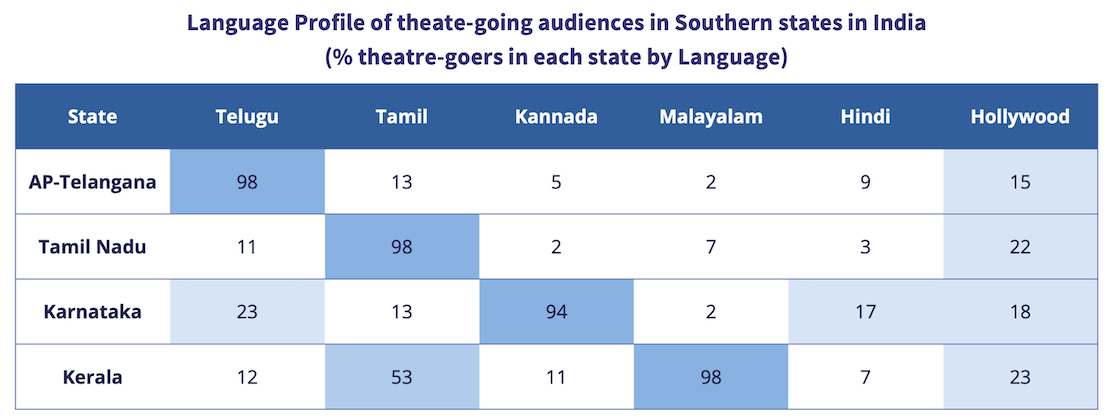

Along with native Kannada language audience being open to dubbed versions of Telugu and Tamil films, compared to the reverse trend, there is also a sizeable audience in the state that speaks other languages, especially Telugu. The chart below, from our report Sizing The Cinema: 2023, shows the language profile of film audiences in South India.

The language factor significantly impacts the theatrical ecosystem support available for showcasing regular, mid-sized Kannada films that release every other week. To overcome this challenge and earn a standing at the box office, starting with a respectable release scale, such movies need to be exceptionally strong on content.

This phenomenon of preferring films of other languages over Kannada could be the result of a gradual change in the audience taste post the limited success of the Kannada film industry in the 2000s. This era was dominated by multiple remakes, with a very limited success rate. Sub-par content experiences over an extended period eventually alienated audiences from content in their own language.

To salvage this, several major stars of the Kannada film industry, such as Darshan, Shiva Rajkumar, Puneeth Rajkumar and Sudeep, came together in 2014, to protest against the release of films from other languages in Karnataka. However, they were fighting a losing battle. Language diversity is inherent to the state. As per the 2011 Census, Kannada is the mother tongue of only 66.5% of Karnataka’s population. This number is on a slow decline over time (68.5% in 2001 Census), for reasons such as the influx of IT talent, especially in Bengaluru.

4. An industry dependent on limited successes

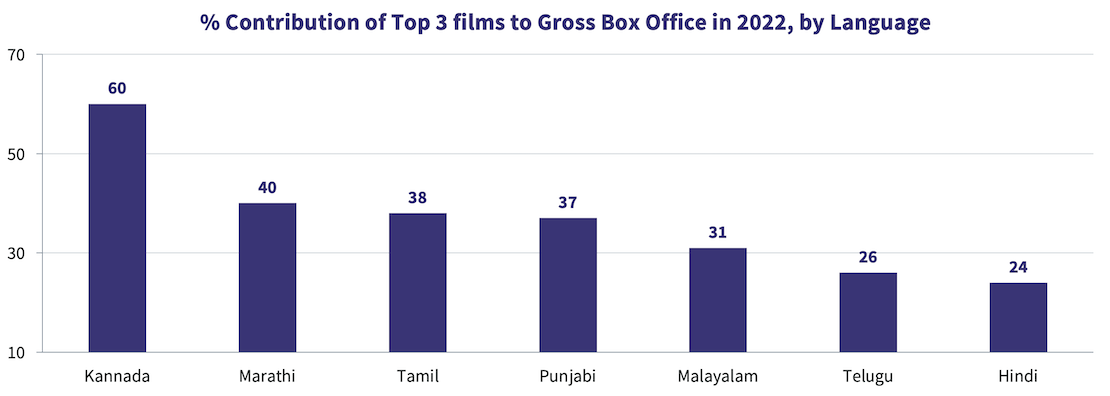

Balanced distribution of box office across multiple films is the measure of the stability of a film industry. More the dependency on a limited number of movies, weaker is the long tail, and lower the stability. The chart below has the percentage contribution of the top 3 films to the 2022 box office of seven major languages.

Kannada film industry’s unhealthy dependence on the top 3 films of the year has been a constant for the last few years. Just three films contributing 60%+ means that the box office is heavily dependent on which these films are in a particular year, and how they perform individually. Which is where the three factors listed above come into play.

This issue, in turn, highlights the absence of multiple bankable stars in the Kannada film industry. Currently, the industry is highly dependent on just two superstars, Kicha Sudeep and Yash. Between them, they control 60% of star popularity share (Ormax Stars India Loves) over the last one year in the Kannada market. Even the Malayalam market is less dependent on its top 2 stars at 47% share between Mohanlal and Mammootty, who are established superstars for decades now (read more about them here).

The momentum provided by K.G.F: Chapter 2 and Kantara in 2022 had presented the Kannada film industry with a great opportunity to start a new wave of original cinema rooted in the state’s culture. 2023 is almost over. One hopes that 2024 gives us a glimpse of that rootedness and originality. Otherwise, 2022 will be seen as an outlier, for an industry that is punching well below its weight.

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

The India Box Office Report: October 2025

Driven by Kantara - A Legend: Chapter-1, October 2025 has emerged as the highest-grossing box office month of the year at the India box office, with gross collections of ₹1,669 Cr

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy