The streaming (OTT) category has grown at a rapid pace in India over the two pandemic years, and this growth has been the subject of various articles on this website too. Original content (web-series and direct-to-OTT films) has dominated the discourse around streaming content over this period. Many big-ticket theatrical films took the streaming route when theatres were closed, leading to sizeable viewership numbers. Similarly, many top-end Bollywood stars have featured in original series, generating both media and audience interest.

While originals drive marketing visibility for streaming platforms, and play a significant role in driving new SVOD subscriptions, there’s another content segment of compelling importance: Theatrical films that can be streamed on OTT after their theatrical runs.

Theatrical content is one of the more mainstream content types in India. Unlike originals, that are popular among early OTT adopters, typically under the age of 30-35 years in the metros and the mini metros, theatrical content holds wider appeal, including in the small towns and among the older audiences. In South India, which contributes 28% to India’s SVOD audience universe, originals are still a nascent idea, and theatrical content dominates viewer interest.

Hence, a platform’s ‘film library’ is a crucial element in its content mix. Which platforms have an edge over the others on this attribute? We decided to find out.

Methodology

We used domestic box office data to identify the top films in six languages: Hindi, Tamil, Telugu, Kannada, Malayalam & Hollywood. Films released between 2016 and 2021 were considered, and domestic footfalls was taken as the selection parameter, with a cut-off of 5 Million footfalls for Hindi, 3 Million for Tamil & Telugu, and 2 Million for the other three languages. This criterion resulted in a list of 373 titles (Telugu: 90, Hindi: 84, Malayalam: 58, Tamil: 54, Hollywood: 49 & Kannada: 38).

For each film, we identified the OTT platform where it can be currently streamed in India. For films available on multiple platforms, the attribution was divided equally, e.g., 0.5 each in case of two platforms. The findings that follow are based on this analysis.

Hindi Films

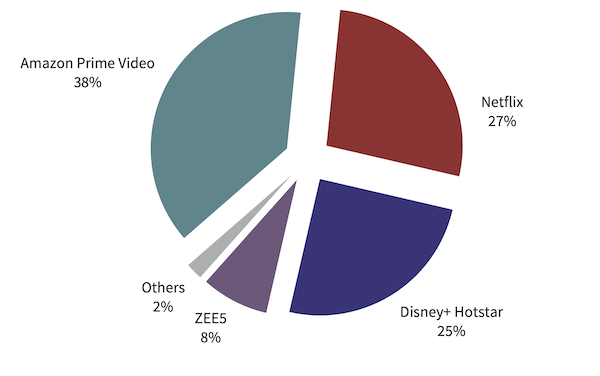

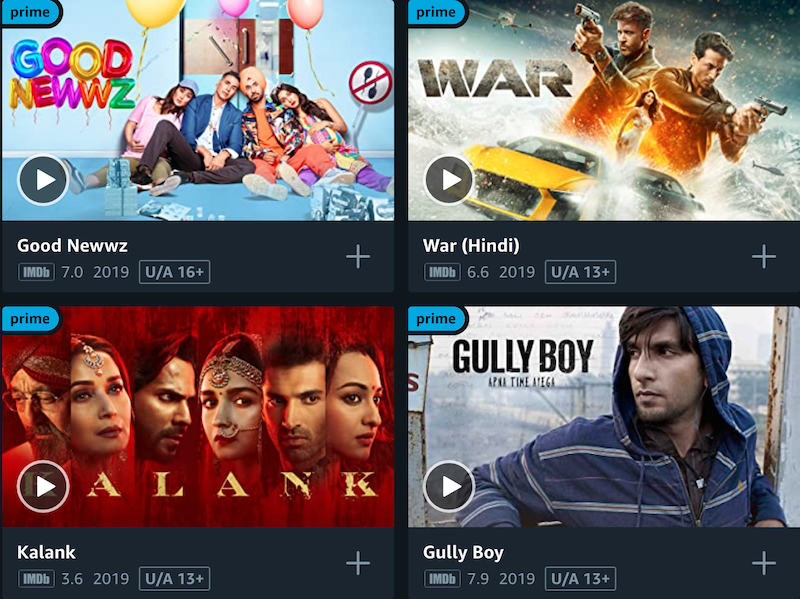

The chart below captures how things stand for Hindi theatrical films on OTT. Amazon Prime Video (APV) leads with 38% share, followed by Netflix and Disney+ Hotstar. The three platforms control 90% share between them, and ZEE5 accounts for bulk of the rest.

Hindi films are the most expensive to acquire for post-theatrical streaming, and some platforms have stayed away from this content category altogether. Netflix’s high share can come as a surprise to some readers, because the platform is dominantly associated with its International content, and ‘Bollywood hits’ is not something most viewers would think of, when they think Netflix.

South Language Films

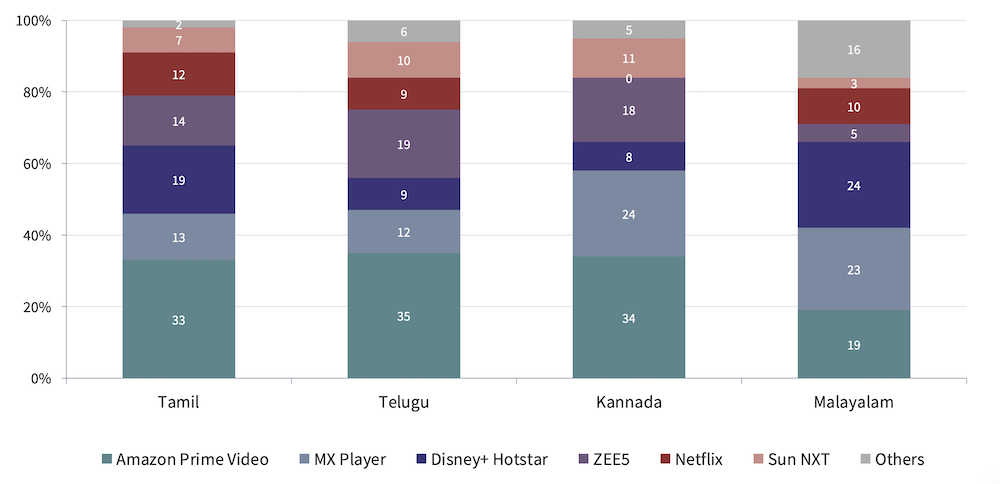

While the platform-level share of top films varies by language (see chart below), APV holds the leadership position in Tamil, Telugu and Kannada languages. An interesting entrant here is the AVOD platform MX Player, which has double-digit share across the four languages, and is a strong no. 2 in Kannada and Malayalam.

Many South films on MX Player are a part of a content-sharing arrangement with Sun NXT. But as can be seen in the difference in the share of these two platforms, MX Player also has a strong film library that’s exclusive to it, in all South languages except Telugu.

Regional platforms other than Sun NXT hold minimal share, with only one of them (ManoramaMax for Malayalam) crossing the 10% mark.

Hollywood Films

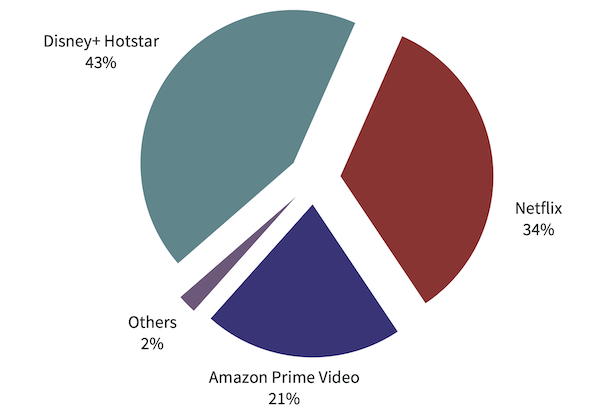

Aided in no small measure by the Marvel and the Disney content on the platform, Disney+ Hotstar controls 43% share of Hollywood films. Only three platforms have any play in this language sub-genre at all.

In Conclusion

Many platforms have avoided investment in streaming rights of theatrical films simply because they come at a huge price, and as a result, three platforms (APV, Disney+ Hotstar and Netflix) dominate this content space. Once pandemic-induced subscriber growth stagnates, a strong library of theatrical films will play a strategic role in SVOD platforms expanding their subscription base in smaller towns and among older audiences. Will the likes of ZEE5, Sony LIV and Voot assert their presence, or leave this playing field for the top three to battle it out? A follow-up analysis at the end of 2022 should answer that question.

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Streaming has a new bias: The male lead

An analysis of 338 Hindi fiction originals since 2022 highlights a growing imbalance in the Indian streaming ecosystem, with male-led stories steadily taking over

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy