Very soon, we will be in the 10th year of original streaming content in India. Permanent Roommates S1, the first noteworthy homegrown web-series, launched in October 2014. The category got a bigger boost with the launch of major players like Amazon Prime Video, Netflix and Disney+ Hotstar, in the 2016-17 period. Even if one takes the launch of Sacred Games S1 (July 2018) or Mirzapur S1 (November 2018) as the commencement point, it’s been a good five years!

Over these five years, there has been a consistent perception, at least in the entertainment industry, that the web-series format enables more layered, intelligent, and bold storytelling, primarily because it’s not dictated by box office, like theatrical movies are. In a country where linear television is too mass to be considered as respectable content by those in the profession of critiquing entertainment, web-series have come to define what good ‘television’ in India can look like. In many ways, being “niche” (i.e., targeting the top 10-15 cities, and not the lowest common denominator in small-town Hindi heartland, as its core audience) became the defining feature of the web-series format. This is aided, in no small measure, by the fact that such content is behind a paywall, which eliminates a section of the mass audience as a potential target group.

But as a category ages, it also evolves in ways different from how one may have anticipated. And there cannot be a better way of understanding this than by using audience data.

Ormax Power Rating (OPR) is our proprietary metric to measure audience likeability of all content, ranging from theatrical films to streaming originals to linear television shows. Audiences who have watched the content (e.g., a minimum of one episode for a web-series) are asked to rate their likeability. OPR is reported on a 0-100 scale, and can be seen as a representation of the show’s inherent content strength, and also a surrogate for its advocacy, i.e., % audience who are likely to recommend the content to their friends or family after watching it. It’s a parameter that forms the central idea of our content testing work across domains (see this explainer for more).

Because it’s calculated using data collected from actual viewers of the content, OPR is a marketing-agnostic parameter, and does not get impact by aspects such as platform reach or viewership, box office opening footfalls, etc. OPR, in turn, leads to stronger conversion of marketing deliverables like first-weekend viewership of a web-series (or first-day box office of a theatrical film) to its lifetime viewership (or box office).

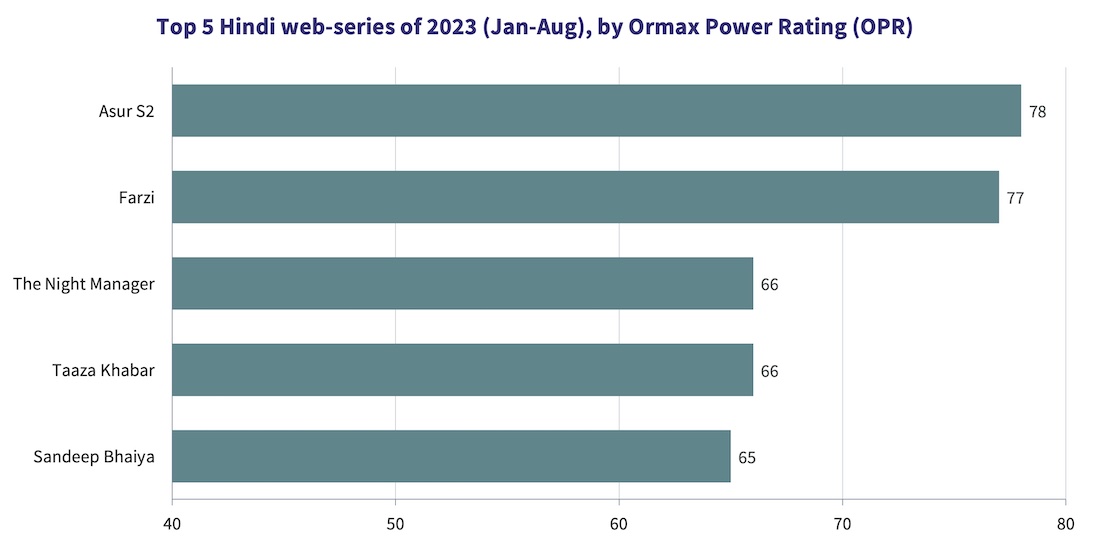

The chart below lists the top 5 Hindi language original series in 2023 (Jan-Aug) based on audience likeability, i.e., OPR. These are also the only five series in the mentioned period with an OPR of 65 or more.

It’s not very difficult to spot common factors in the list above. The top four are cinematic in their tone and treatment. And this is not about the presence of known Bollywood faces. Taaza Khabar, which stars one of India’s top social media influencers, Bhuvan Bam, is perhaps the most ‘cinematic’ of the five, with its larger-than-life portrayal of its lead protagonist. Sandeep Bhaiya may be the least cinematic of them, but like many feel-good Hindi films, the show’s emotions are rooted firmly in Indian culture, making it comforting and accessible, compared to the dark action and crime dramas the category is overflowing with.

As per our weekly viewership estimates, these five shows have an estimated combined viewership of 114 Million audiences in India. Together, they define what ‘success’ looks like, in the web-series space in India in 2023 so far, even though they come from very different genres, and represent fairly distinct styles of storytelling.

Two other shows in the 60+ OPR list, Taali and Rana Naidu, though as disparate from each other as chalk and cheese, are unified by a treatment style that’s not apologetic about dialing up the drama and the emotions, to appeal to a wider sensibility.

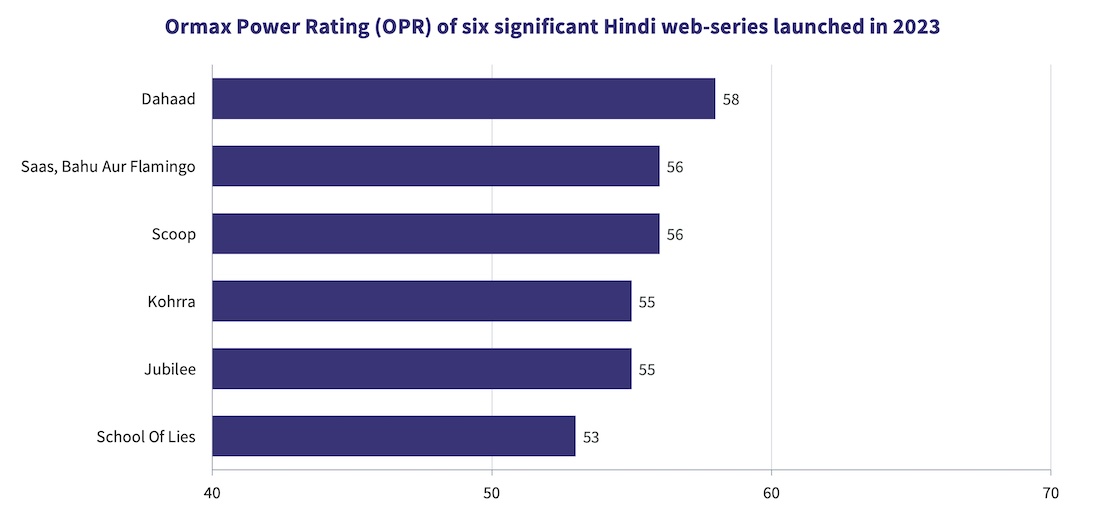

Much as the 60s OPR bracket is interesting, a look in the 50s bracket tells an even more fascinating story. The six shows in the chart below are worth highlighting.

These are some of the best-reviewed Hindi web-series of 2023. They have some of India’s most powerful cinema voices backing them, as producers, showrunners, and directors. They have been appreciated for their sensitive portrayal of complex themes and settings. They are the kind of shows many top actors would want to be a part of. It could even seem that these shows are driving the narrative, as far as the evolution of streaming originals in India is concerned.

But the audience appreciation is far less emphatic, as indicated by the OPRs in the 50s. The combined India viewership of these six shows is 64 Million, a per show average of less than 50% of the viewership of the 65+ OPR shows above.

It may be a bit early to ask, but the question is an inevitable one: Is streaming headed the television way? In the 1990s, the first decade of satellite television, many of the hit shows featured urban, mature stories. In one of the earliest Zee TV fiction shows from that time, Tara (1993-97), female characters would drink beer on screen. A decade later, that was impossible to imagine in a hit TV show. As the reach of the television medium expanded, and the measurement universe also widened to keep pace with it, the lowest common denominator audience shifted from the mini-metros to the small towns. This progression has continued over the years. Forget Delhi, Ahmedabad or Indore, even Kanpur or Gwalior do not represent mass Hindi urban TV audience anymore. The lowest common denominator drives the idea of ‘inclusion’, and a hit show must address this idea, by definition.

For the first few years, OTT originals were seen as addressing a niche, even premium, market. But the pandemic has widened the reach considerably, and with JioCinema’s entry this year, free content may just be the future ahead. The lowest common denominator will move out of the top 10 cities to the next tier. The OPR and the viewership numbers shared above are a first sign of this change.

Whether this change is a good thing or a not-so-good one is subjective. But what's not subjective is that the future of streaming originals in India looks very different from how the first phase was. It may be a good time to unlearn and re-learn. Which is quite an apt thought on Teachers’ Day. The audience is the greatest teacher, after all!

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Streaming has a new bias: The male lead

An analysis of 338 Hindi fiction originals since 2022 highlights a growing imbalance in the Indian streaming ecosystem, with male-led stories steadily taking over

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy