The sheer volume of original content being churned out on Indian OTT platforms has been a topic of analysis on this website, such as this May 2023 article. As of mid-November, 150 Hindi language originals (web-series and direct-to-OTT films) have launched in the year 2023, of which more than 100 are on pay (SVOD) platforms. These numbers do not include several mid and low-budget shows launched on YouTube. Add to this, the various International and other Indian language properties, and we are speaking of about 5-6 new options for the viewer every week, even as they try and keep pace with the ones launched in the previous week or two!

Now imagine all this in the midst of 3-4 months of hectic sporting action, including IPL, and events like the currently-underway Cricket World Cup. It is no surprise that most originals are failing to make a mark, and fizzling out within days of their launch, even when the content itself is above par.

Our OTT tracking tool, Ormax Stream Track, tracks campaigns for new OTT originals, reporting their performance on several audience parameters, including one called Buzz. This parameter is a measure of % audience who recalled the original property (web-series or direct-to-OTT film) unaided, when asked to recall upcoming or recently-launched streaming properties. Buzz is a strong indicator of the talk value of the property, i.e., the degree and effectiveness of conversations around it among regular audiences of OTT originals.

In the last six months, there have been only 11 instances of an OTT original scoring 20%+ Buzz in any given week. Asur S2 (JioCinema) managed to do so four times, and Guns & Gulaabs (Netflix) twice. The remaining five instances belong to Citadel (Prime Video), Bloody Daddy (JioCinema), The Night Manager (Disney+ Hotstar), Bawaal (Prime Video) and Aarya S3 (Disney+ Hotstar), all crossing the 20% mark for a week each.

In early May, we expanded the scope of Ormax Stream Track to include the launch of theatrical films on OTT. In this period (six months), there have been 23 instances of a theatrical film achieving the 20%+ Buzz mark: Gadar 2 (5), OMG 2 (4), Jailer (4), Adipurush (3), Rocky Aur Rani Kii Prem Kahaani (2), Tu Jhoothi Main Makkaar (2), Bhediya (1), Satyaprem Ki Katha (1), and the recently-launched Jawan (1). Jawan dropped on Netflix on November 2, and recorded a launch-week Buzz of 53%, the highest any property has managed on OTT, since The Family Man S2 in June 2021.

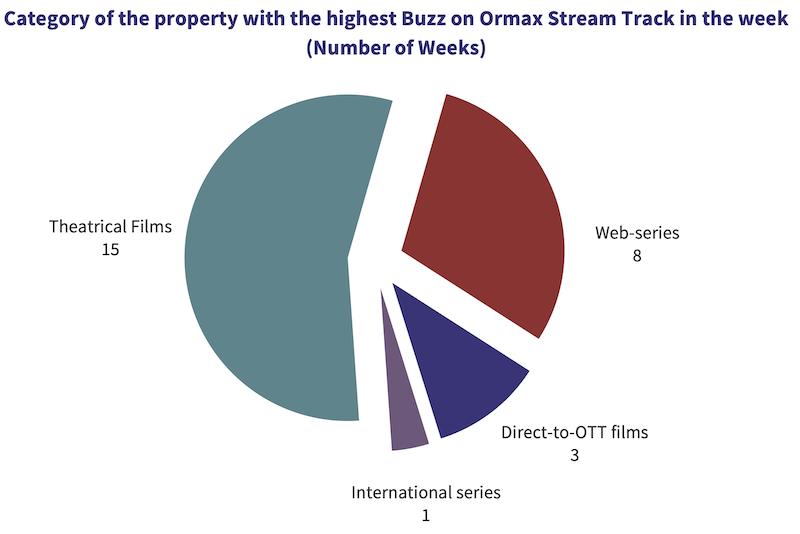

The chart below captures the category to which the property with the highest Buzz of the week belongs, over the last 27 weeks, i.e., from the time we started tracking theatrical films in Ormax Stream Track. The dominance of theatrical films over OTT originals is unmistakable. For every single week since the last week of August, the property with the highest Buzz has been a theatrical film.

There are several ways to look at the findings listed above. Of course, there is the marketing factor. In comparison to a web-series or a direct-to-OTT film, a theatrical film has been through 4-8 weeks of promotions leading upto its original release in the cinemas, followed by organic (audience-sustained) marketing in the post-release period. This gives a theatrical film significant familiarity before the OTT platform spends any effort or money to promote its streaming launch.

But there’s more to streaming performance of theatrical films than just their strong marketability. It’s safe to say that despite streaming being an established category in India now, the Indian OTT viewer continues to be in the awe of stardom that big-ticket theatrical content offers. Web-series with theatrical stars have consistently performed well. Farzi (37.1 Million), Rudra: The Edge Of Darkness (35.2 Million) and The Night Manager (28.6 Million) are three of the most-watched Hindi web-series in India since the start of 2022, based on our estimates.

There’s a reason for this. As per The Ormax OTT Audience (Profiling) Report: 2022, 73% of Indian SVOD audiences are regular theatre-goers too. Many SVOD viewers are cinema viewers, even fans, who have added OTT content to their viewing mix in the last few years. Their yardsticks to evaluate content on OTT are derived from their film-viewing taste established over time.

This also implies that an SVOD viewer’s taste palate for OTT originals (especially web-series) is still being developed. In other words, the relationship between the web-series format and the SVOD audience still does not have a defined identity. Apart from suspense and crime thrillers, there is no clear second or third signature genre. As a result, while the viewing behaviour has evolved with the growth of the OTT category, factors that define talk value around a piece of content still find their roots in our well-established cinema culture.

This recent article on this website argued that the web-series content should look to be more cinematic if it needs to address the wide demographic available as potential target audience in India. The ‘buzzing’ performance of theatrical films among OTT audiences is yet another reflection of this insight.

A couple of years ago, there were suggestions that the cinema medium will struggle to stay afloat post the pandemic. Far from it. Cinema is alive. And not just on the big screen. It is influencing how the streaming medium is shaping up too!

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Ormax Cinematix's FBO: Accuracy update (December 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major December 2025 releases vis-à-vis their actual box-office openings

The India Box Office Report: November 2025

November 2025 was an underwhelming month at the India Box Office, recording only ₹587 Cr in gross collections. However, the year stays on course to become the highest-grossing year of all time

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy