By Nabil Shaikh, Swayam Kumar

Hollywood films have had a rollercoaster run at the Indian box office over the past decade. In the late 2010s, they rode high on the capes of superheroes, achieving unprecedented box office success in India. But the pandemic brought that momentum to a halt, and the years since have been those of decline. In this analysis, we dive deep into Hollywood’s India box office journey - from the pre-pandemic peak powered by the Marvel Cinematic Universe (MCU) and other superhero franchises, to the post-pandemic landscape where Hollywood’s share has ebbed, but fresh genres beyond the superheroes have emerged as contenders.

The 2019 Peak

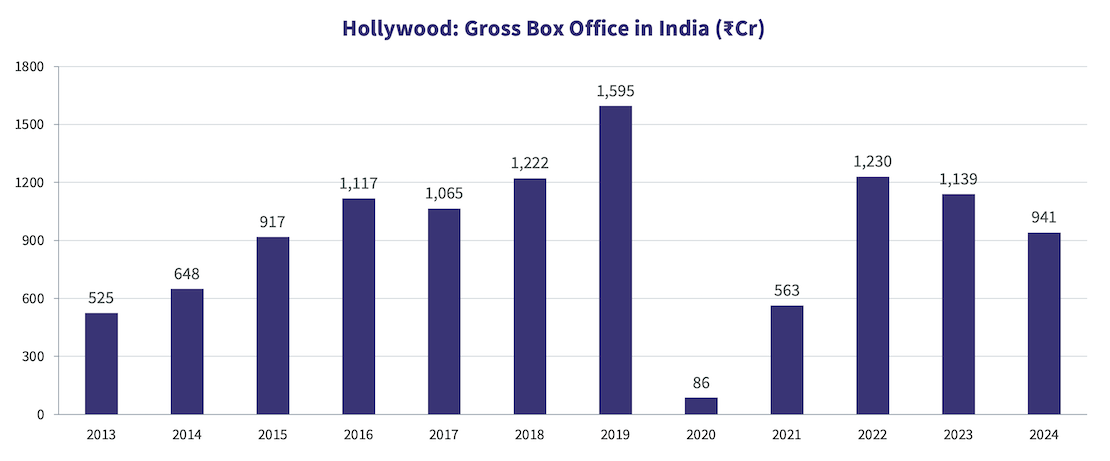

The chart below captures the year-on-year cumulative gross box office of Hollywood films in India, from 2013 to 2024.

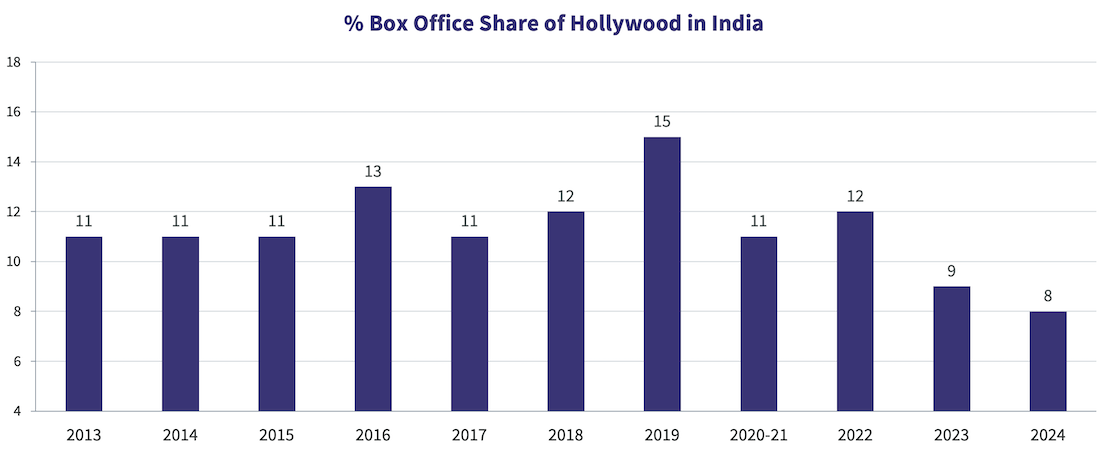

Hollywood’s earnings in India climbed steadily through the 2010s, reaching an all-time high of ₹1,595 crore in 2019. This growth was dramatic - Hollywood’s slice of the Indian box office reached a sizeable 15% in 2019, making it the second highest contributor by language (behind only Hindi cinema). 2019 became a landmark year for Hollywood in India, as total Hollywood gross in India (across English and dubbed versions) exceeded those of the Tamil and Telugu industries.

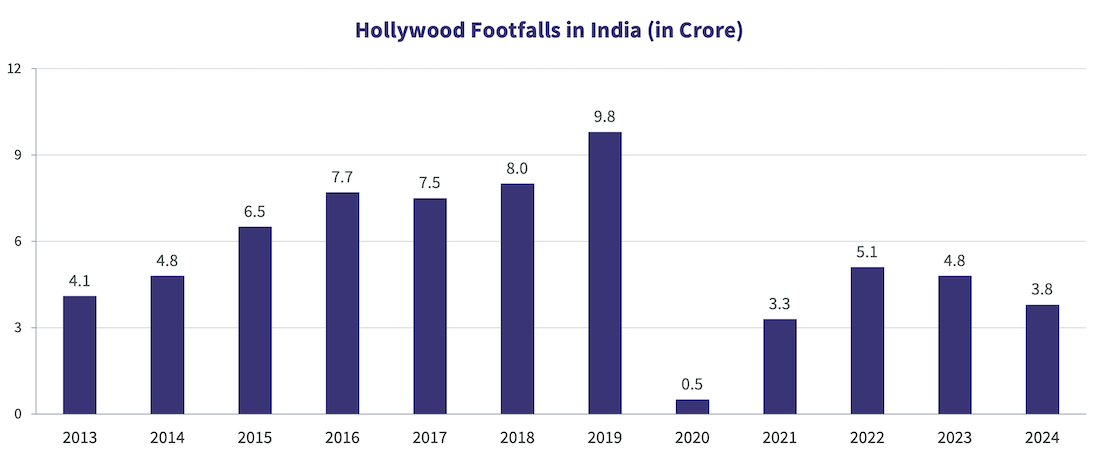

Indian audiences, increasingly exposed to global content and lured by big-screen spectacle, were turning out in record numbers for Hollywood releases. This pre-pandemic boom was fueled by event films that became virtual holidays for young urban audiences. Global franchises invested heavily in localized and tailor-made marketing for the Indian audiences. The strategy paid off handsomely, and by 2019, Hollywood studios were no longer niche players in India – they were vying with local industries on the top grosser charts. It truly seemed like Hollywood had found its stride in India, with superhero movies leading the charge. But as the pandemic hit in 2020, an important question emerged: How long was this peak going to last?

Superheroes: From Vanguard to Fatigue

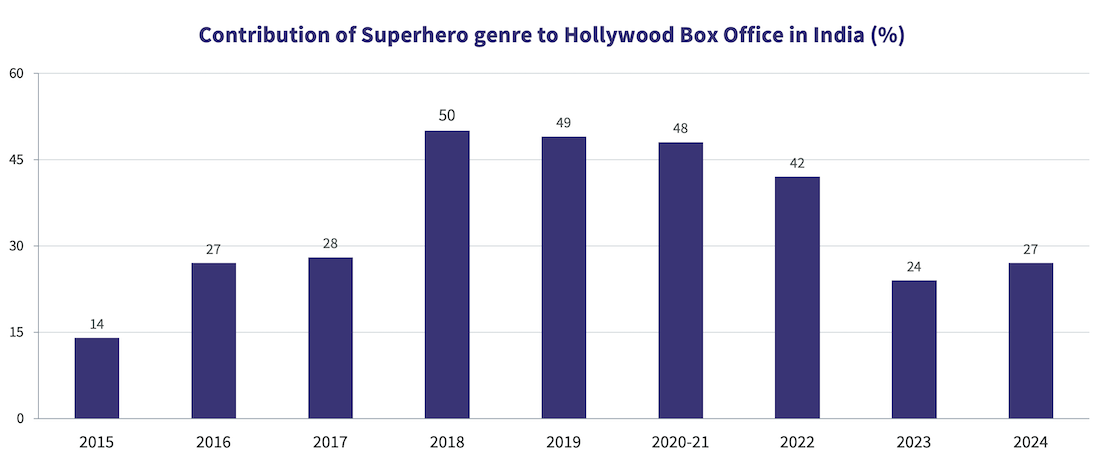

If one genre can be credited for Hollywood’s late-2010s dominance in India, it’s the superhero genre. The MCU (and other competing universes such as DCEU) built a massive fan following in the country. Each new Avengers installment became a bigger event than the last. Avengers: Endgame (2019) was the pinnacle. It opened upward of ₹50 Cr on its first-day, and went on to gross a record ₹433 Cr in India. That year saw multiple superhero hits of varying levels – Captain Marvel, Spider-Man: Far From Home, Joker, Shazam! – all of which contributed to a major chunk of Hollywood’s ₹1,500+ Cr tally.

This was a period when the supply was ample too. Marvel Studios alone rolled out three films each in 2018 and 2019, each eagerly anticipated by fans, while DC and other franchises added to the count. This quantity + hype combination made superheroes the vanguard of Hollywood’s surge.

However, maintaining this momentum proved challenging in the aftermath of Avengers: Endgame. Additionally, Robert Downey Jr.’s portrayal of Iron Man, and the character’s death in Avengers: Endgame, culminating a decade of universe-building, became a watershed moment for superhero fans in India. While MCU’s Phase 4 (2021–22) introduced a slew of new heroes and stories, the reception was severely muted. Globally, the notion of “superhero fatigue” began to gain traction - and India was no exception.

Post-Endgame, select MCU films still drew crowds (e.g., Doctor Strange in the Multiverse of Madness managed a respectable run in 2022), but they no longer broke records. Many underperformed relative to expectations, echoing a worldwide trend where nearly every superhero movie in 2023 fell short of the billion-dollar mark (none even crossed $400M in the US, with only Guardians of the Galaxy Vol.3 and Spider-Man: Across the Spider-Verse coming close). Even DC’s iconic characters struggled. Films like The Flash and Shazam! Fury of the Gods fizzled out quickly. The franchise fatigue post-Endgame emerged as a new challenge, as audiences grew pickier about which cape-wearing adventures were truly theatre-worthy.

Pandemic Blues and Hollywood’s Decline in Share

As a result, Hollywood’s overall market share in India shrank from around 15% in 2019 to single digits by 2023. This was also mirrored in the decline in footfalls, with numbers dropping from 4.8 Cr (2023) to 3.8 Cr (2024), making 2024 one of Hollywood’s weakest years in India.

Crucially, the impact of superhero releases on Hollywood’s India earnings has been diminishing. Before the pandemic, a single Marvel mega-release could contribute 20–30% of the entire annual Hollywood box office in India. But after 2020, this trend saw a visible decline. Spider-Man: No Way Home (Dec 2021) was a notable exception. Tapping into nostalgia and a franchise-crossover buzz, it grossed about ₹250 Cr in India and single-handedly buoyed Hollywood’s 2021 recovery. Outside of it, though, other Marvel Phase 4 titles (Eternals, Black Widow, and Shang-Chi) managed only modest numbers in India.

By 2022, Indian theaters had fully reopened, but Hollywood released fewer films than before, and while big tentpoles like The Batman, Doctor Strange into the Multiverse of Madness, Jurassic World Dominion, and Avatar: The Way of Water kept the box office going, it wasn’t a record year. In 2023, the Indian box office soared to a record ₹12,000 Cr overall, yet Hollywood’s share dipped to 9%. The share of the superhero genre saw a steep decline, from a peak of 50% in 2018-19, to less than 25% in 2023.

New Blockbusters on the Horizon

Interestingly, as superhero fare lost its dominance post-pandemic, other Hollywood blockbusters stepped into the limelight in India. Audiences, still hungry for grand spectacle and strong storytelling, began embracing sci-fi epics, biographical dramas, creature features, and animated adventures. The biggest example is James Cameron’s Avatar: The Way of Water which grossed ₹471 crore in India, surpassing Avengers: Endgame as the highest-grossing Hollywood release ever in the country. Drawing on the legacy of the first Avatar film, and Cameron’s immersive 3D world, it appealed across demographics, proving one needn’t have to be a superhero film to captivate Indian viewers (read this analysis on the film's exceptional performance in South India).

Another standout was Christopher Nolan’s Oppenheimer: an R-rated, dialogue-heavy film that still fetched ₹158 Crore in India, helped by Nolan’s fan following, the film’s IMAX “event” stature, and the much-discussed “Barbenheimer” phenomenon in July 2023. Even earlier Nolan titles, like Interstellar, have enjoyed re-runs and sustained interest, illustrating that the Indian audience has an appetite for mind-bending, high-concept filmmaking.

Beyond these blockbusters, the Monsterverse (read more here) caught on during the pandemic reopening phase, signaling an eagerness for large-scale creature battles. Meanwhile, animated features like Spider-Man: Across the Spider-Verse, The Super Mario Bros. Movie, and Frozen 2 have all found traction, proving that Hollywood’s success in India now spans a broader range of genres. 2024 saw five animated films namely Mufasa: The Lion King, Kung Fu Panda 4, Inside Out 2, Moana 2, and Despicable Me 4 in the top 10 Hollywood-grossers in India, even as the once-dominant superhero genre has significantly faded.

By aligning innovative content with robust marketing campaigns, Hollywood will hope to recapture momentum in India. Post-pandemic successes like Avatar: The Way of Water and Oppenheimer, along with a rise in appeal for animated films, demonstrate that while the superhero wave may have fallen, Indian moviegoers still crave cinematic experiences that promise spectacle and quality. However, the peak of 2019 may not be easy to reach anytime soon.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy