Is linear television fighting its impending death? This question has been posed to us several times in recent years. While the reach of the medium (about 900 million in India) means that it addresses a sizeable audience, to the tune of about 400 million incremental ones who do not have access to streaming content, the sentiment towards the medium has not been the best in recent times.

For one, the audience profile of the linear television medium seems to be getting ‘older’ with time. Viewership data from BARC India does not capture this reality too well, because co-viewing by younger members of the family continues to exist. But our qualitative work increasingly suggests that younger audiences are watching linear television with growing levels of distraction, and have only a marginal role to play in influencing content selection in single-TV households, except marquee sports events.

But this is a life-stage influenced change, and median age of the remote in-charge in Indian TV households is likely to settle in the 35-40 years bracket, at least for another decade. It has, in any case, been around 35 years on weekdays for a decade now (download our 2021 report here for more).

The real question to ask, to gauge the likely relevance of linear television in the coming years, is: Is the linear television medium satisfying any unique needs anymore?

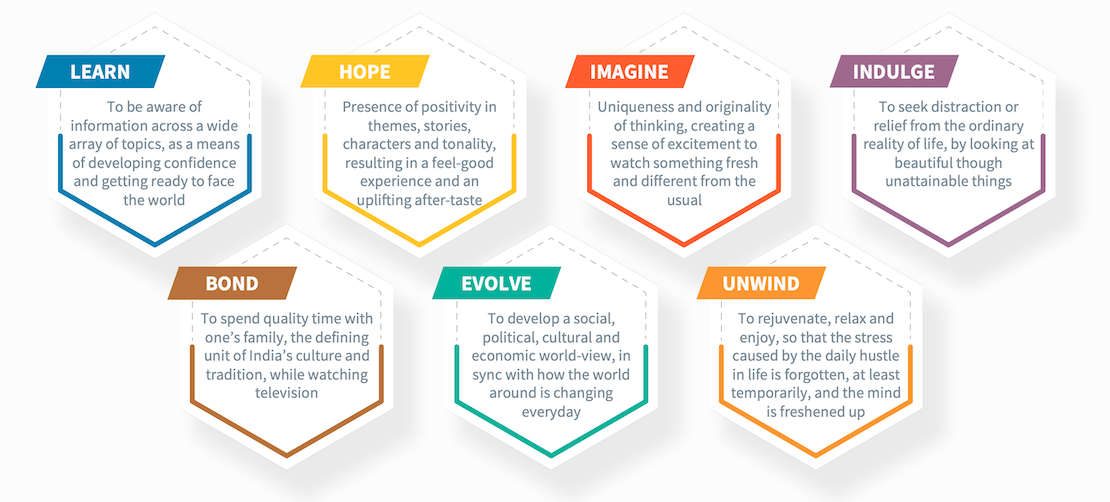

In 2021, Ormax Media formulated the Seven Needs Model for Indian television, a framework we have since used extensively in our television work. This model postulates that television is eventually watched for only seven reasons in India. While the relative weights of these seven needs will vary by language and genre, between these seven, all possible reasons for watching a particular genre, program, character, or any other piece of content, can be explained. More than two years of rigorous work went into identifying these needs. The chart below captures these seven needs, and their one-line definitions.

Let’s look at how ‘exclusive’ each of these needs is to television. In other words, is the medium managing to steer clear of competition in the form of digital content, ranging from long-form OTT content to short-form social media content, on these needs? Linear television would be in trouble if the answer to these questions was in the negative for all (or most) of the seven needs.

Learn

YouTube and social media content is the primary port of call for this need today, where the need is satisfied on demand, and in real time. However, television news (along with print) continues to be seen as a more credible source of news than digital media, where fake news concerns loom large. However, this is a tenuous position, especially because the narrative around Indian news channels hasn’t been the most positive in recent years.

Overall, it can be concluded that Learn is not a need linear television can claim to be fulfilling uniquely or more effectively. With growing penetration of social media, television will continue to struggle on standing out based on this need.

Hope

In what can be a called a baffling miss, the streaming industry has let go of this need in its growth period. This 2023 analysis by my colleague Abhinav Chandekar concludes that web-series content continues to be overly cynical, and explains why that’s an opportunity lost, in terms of audience expansion, especially outside the big cities.

Social media can be fairly cynical too, depending on how the algorithms play out for specific users. To that extent, mainstream television shows, such as Taarak Mehta Ka Ooltah Chashmah, continue to hold relevance. While this need is not definitional to television, in the current scheme of things, television is offering it in higher doses than digital media, especially for mass Indian audiences in the medium’s core profile (married audiences outside the top metros).

Imagine

This is one need on which linear television is on severely weak footing. Uniqueness and originality are not words that even the most diehard TV audiences associate with the medium. Instead, social media, through its viral content and trending topics, is driving this narrative. The marginalization of niche genres like infotainment from linear television has further contributed to Imagine not being a need unique to, or strongly served by, television.

Indulge

Despite higher production budgets for films and web-series, they have not managed to serve this need for a wider audience, Theatrical films promise larger-than-life experiences, which are directly linked to the Indulge need. But most theatrical films, at least in Hindi, primarily target 15-34 year old audiences. And web-series do not deliver on this need, because of the same reasons as those related to the need Hope above: dark and cynical content that’s more engrossing than indulging.

Television’s sit-back-and-relax feel adds to this need, by servicing the first part of its definition (“To seek distraction or relief from the ordinary reality of life”). And “unattainable things” need not be highly unattainable. Fashion, for example, is a big draw for female audiences, who use GEC shows as a source of fashion trends, gazing at the striking costumes, jewelry, houses, and even picking up trends for self-use when they can (a bit of the Learn need comes into play here).

Bond

This need is television’s unique calling card. I wrote this piece on this topic two-and-a-half years ago, and it holds true even today. This need is umbilically linked to the familial structure in India, and the inability of digital media to align to this structure. OTT and social media consumption, despite the growing penetration of connected televisions, is predominantly solitary in nature, and television becomes the one reason why families can spend time together via a set routine.

This need isn’t going anywhere, anytime soon. And for that reason, television will continue to hold significance. For the Bond need to lose its unique status, either the dependence of our social structure on the institution of family will have to weaken (can’t see that happening for at least two decades), or streaming platforms will have to address this need more proactively (possible in theory, but no practical evidence so far).

Evolve

While social media and YouTube should primarily be driving this need, fiction content is still the most potent form of delivery for the Evolve need, which is why GEC content, especially shows like Anupama, continue to hold relevance. In this recent analysis, my colleagues Keerat Grewal and Aakriti Bhatia, wrote about a radical and progressive shift in the Hindi GEC category, whereby the share of working women among the most popular female characters has gone up from a meager 20% in 2020 to a staggering 80% in 2023. Silently but surely, mass television is scripting an evolution narrative for its audiences.

Unwind

Fundamentally, this need is media-agnostic. Content that can destress can be found in good measure across media. Television is on a weaker footing here, compared to on-demand media, where one can search for such content, or can be served the same endlessly, thanks to evolved algorithm that only seem to know us too well by now. In the South markets, television continues to drive this need more significantly than in Hindi, through a wide array of non-fiction shows. In Hindi, even Kapil Sharma, the poster boy of Unwind, has moved to streaming.

Conclusion

Of the seven needs, one need (Bond) is highly unique to television, while three others (Hope, Indulge and Evolve) are strong for television because digital content hasn’t addressed them adequately so far. The remaining three needs (Learn, Imagine and Unwind) do not have any obvious layers unique to linear television.

As and when digital content begins to address the Hope-Indulge-Evolve trio, television would be more vulnerable, as relying only on one need may not be the best idea, especially from an engagement (time spent) perspective. But till that happens, television is reasonably safe, even as digital penetration will continue to grow, bridging the gap between linear television and digital video content.

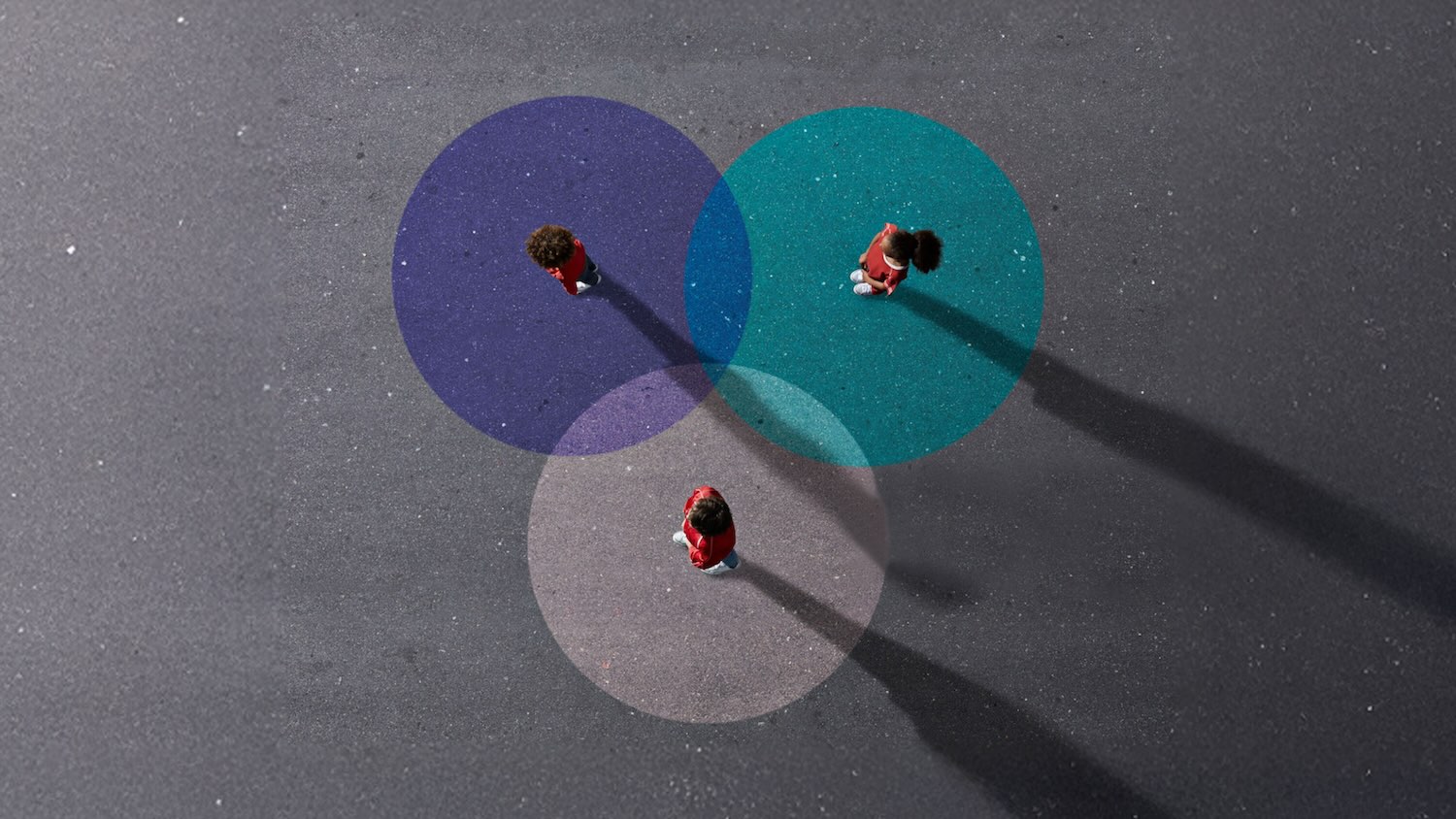

Venn It Happens: OTT & Linear TV audience intersection

The first edition of our new feature Venn It Happens illustrates the intersection between OTT and Linear TV audiences in India, using data from The Ormax OTT Audience Report: 2025

Not just nostalgia: Why legacy characters are dominating HGECs

Despite not featuring in the show since 2017, Daya (Taarak Mehta Ka Ooltah Chashmah) continues to enjoy immense popularity among Hindi GEC audiences. Her enduring success highlights a category trend

Ormax Mpact case study: Bandhan Mutual Fund on India Today TV

This case study, based on the integration executed by Bandhan Mutual Fund on English news channel India Today, showcases our Brand Lift measurement tool Ormax Mpact

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy