By Our Insights Desk

For pay (SVOD) streaming platforms, theatrical films continue to be a key driver of customer acquisition. In The Ormax SVOD Audience Report: 2024, theatrical films outscored original content formats such as web-series and direct-to-OTT films on audience appeal. Similarly, insights from our Ormax Stream Track reports reveal that theatrical films consistently outscore originals on Potency, a metric that captures the ability of a piece of content to attract new subscribers.

Acquiring theatrical film rights can be costly, and platforms often prefer to deploy their content budgets in creating IPs they own. However, the undeniable audience pull of theatrical films makes this content category difficult to overlook.

So, which streaming platforms have a stronger presence in the theatrical films category, and how does the platform distribution mix of theatrical films on streaming impact both the streaming and theatrical industries? Here’s an analysis.

Methodology

This analysis focuses on theatrical films released in Hindi, Tamil & Telugu languages, between 2022 and 2024, with domestic footfalls of 1 million or more. A total of 323 films across the three languages and the three years were thus identified. Other languages have not been considered, due to limited number of films crossing the 1 Mn mark annually, making it difficult to identify meaningful trends.

For each of the 323 films, the OTT platform where the film is currently available for streaming in India was identified. Films available on multiple platforms were attributed equally to them, e.g., an attribution of 0.5 each if a film is streaming on two platforms.

Hindi films

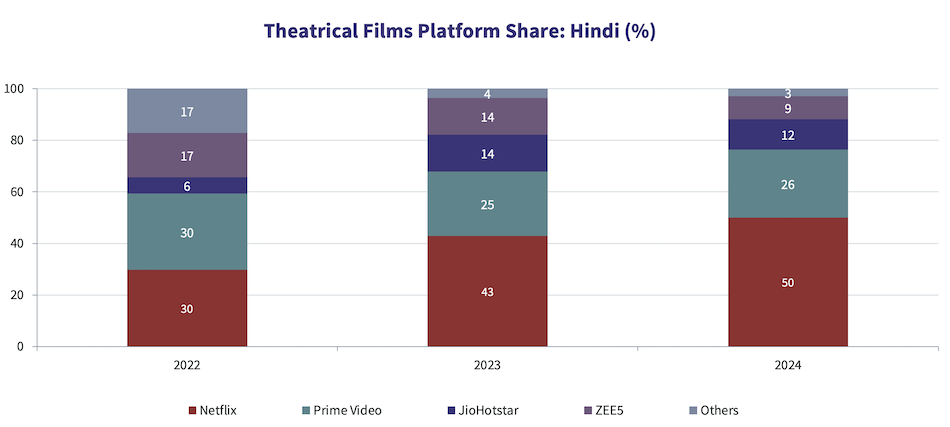

The chart below illustrates the platform share of Hindi theatrical films released over the past three years. Netflix’s dominance has grown significantly during this period, with its share rising from 30% to 50%.

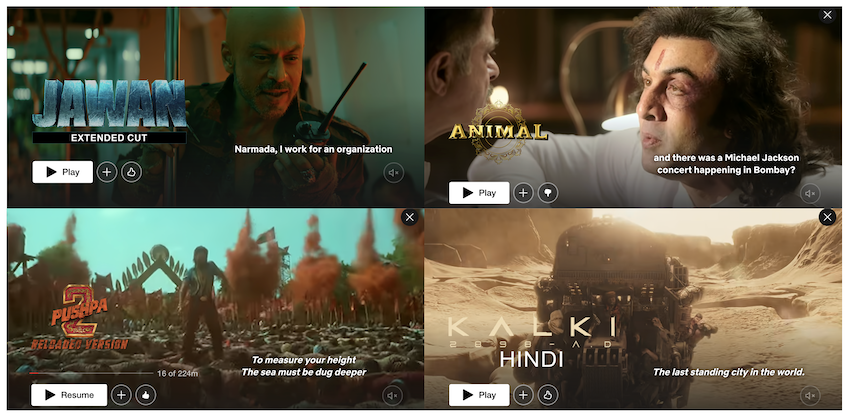

Netflix has licensed some of the biggest Hindi blockbusters in recent years, including Jawan and Animal, as well as the Hindi streaming rights for Pushpa 2: The Rule and Kalki 2898 AD, solidifying its strong presence in this category.

Consequently, the combined share of Netflix and Prime Video now stands at 76%, indicating marginalisation of other platforms on this metric.

Telugu films

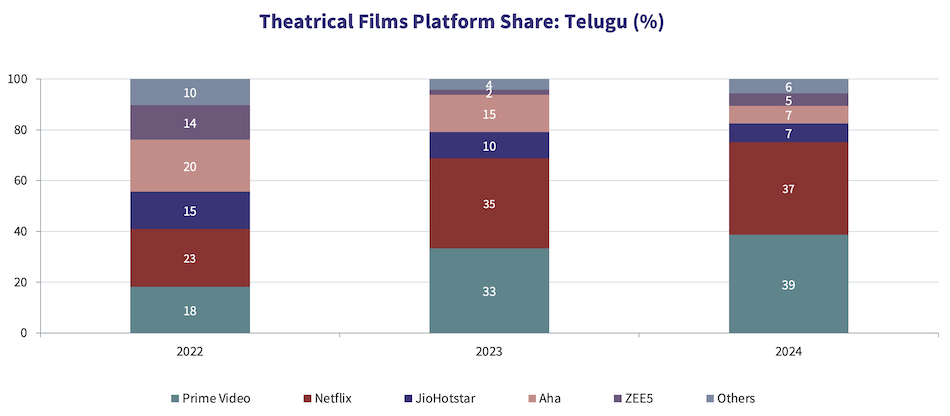

Netflix & Prime Video also dominate the Telugu market, holding a combined share of 76% for 2024 releases, a significant increase from just 41% for 2022 releases. All other players, both national (JioHotstar and ZEE5) and local (Aha), have slowed down their acquisition of Telugu theatrical rights in 2023 and 2024, allowing Prime Video and Netflix to emerge as the dominant players in this space.

Tamil films

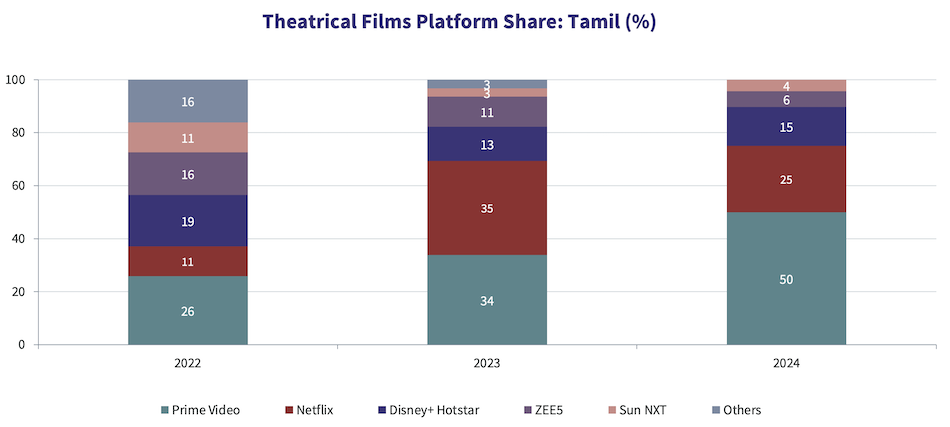

The Tamil market mirrors the Telugu trend, with Prime Video and Netflix collectively holding 75% share for 2024 releases, up from just 37% in 2022. Prime Video has emerged as the dominant player for Tamil theatrical films in 2024, ahead of Netflix.

Implications

This duopolistic landscape grants Netflix and Prime Video greater negotiating power, effectively turning the market for streaming rights of theatrical films into a buyers’ market. This stands in stark contrast to 2020 and 2021, when multiple streaming platforms, including local players, were competing to acquire theatrical film rights (including those of films unable to release in cinemas due to the pandemic), enabling film producers and studios to command high prices. If the newly-merged platform JioHotstar enters this space with more intent in 2025, it could lead to a more balanced distribution of titles – a scenario the Indian film industry will be eagerly hoping for!

Urban romcoms: The Delhi NCR story

An analysis of why Delhi NCR contributes disproportionately to the box office of urban Hindi romcoms

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

The Ormax Box Office Report: 2025

Powered by Hindi cinema’s strong comeback, 2025 became the biggest year ever at the Indian box office, with gross collections of ₹13,395 Cr, even as footfalls stayed flat

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy