By Our Insights Desk

The Hindi box office has been struggling over the last few months, with only a few tentpole films delivering, even as many other films have under-performed, despite good starcast and promotions. Clearly, the audience is being highly selective in picking films they want to watch in theatres.

While there are many hypotheses cited as being the root cause of this change in audience behaviour post the pandemic, the most popular of these is about the availability of films on streaming platforms (OTT) within eight weeks of release. It is argued that this eight-week window dissuades a larger set of audience, especially in the metro and mini-metro markets, from visiting movie theatres to watch a film that's not high on spectacle or franchise value, because it will become available to them 'free', as a part of their existing subscription of a leading streaming platform, such as Netflix, Prime Video or JioHotstar.

In this analysis, we examine this hypothesis, by looking at two questions:

1. Are audiences aware of the eight-week theatrical-to-OTT window?

2. Does their awareness of the window impact their decision to watch films in theatres?

Awareness of Theatrical-to-OTT Window

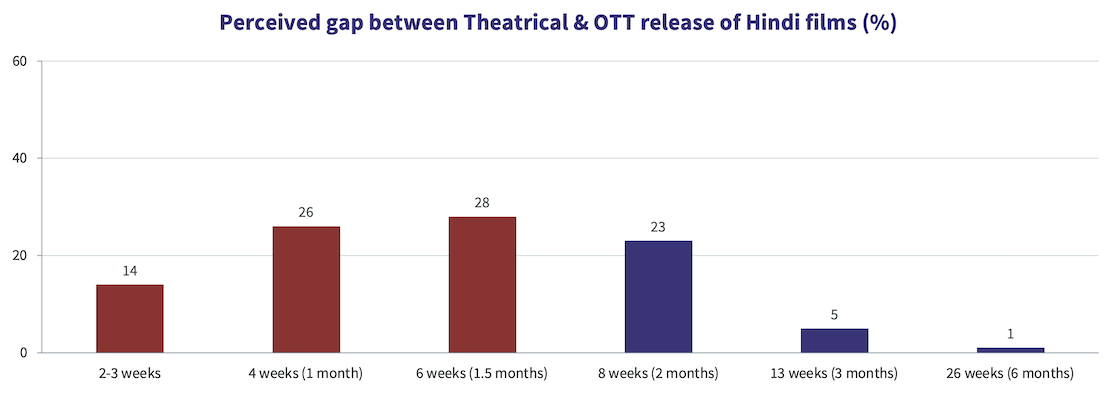

In a survey conducted using our box office tracking and forecasting tool Ormax Cinematix (OCX), regular theatre-going Hindi audiences were asked about the perceived gap between theatrical and OTT release of Hindi films. They were asked to pick from seven options provided to them. The chart below captures what percentage audience picked which option:

A staggering 40% feel that Hindi movies are available on OTT within four weeks of release (the first two bars in the chart above). Another 28% believe six weeks is the typical gap. Between these three options (highlighted in red in the chart), 68% audiences, i.e., more than 2 out of 3, are accounted for. Only 29% perceive the gap to be eight weeks or more (the remaining 3% being those who picked 'Don't Know').

Clearly, the perceived window is shorter than the actual window, which is supposedly alarming for the theatrical business, because the shorter the perceived window, the higher the dissuasion to visit a movie theatre would be, if the hypothesis in question were true.

But to establish if the hypothesis is true, we need to see if the awareness of the theatrical-to-OTT window is impacting how regular Hindi theatre-goers are responding to upcoming movie campaigns, and whether the perceived awareness of the window is influencing their decision to buy a movie ticket.

Impact on Box Office Opening

OCX reports three audience parameters, namely Buzz, Reach and Appeal, captured using primary research, with a weekly sample size of 2000+. Buzz refers to the unaided recall of the film, i.e., % audience who named the film, when asked to name as many upcoming films as they could. Buzz is a strong indicator of the talk value of the film, i.e., the degree and effectiveness of conversations around the film among theatre-goers.

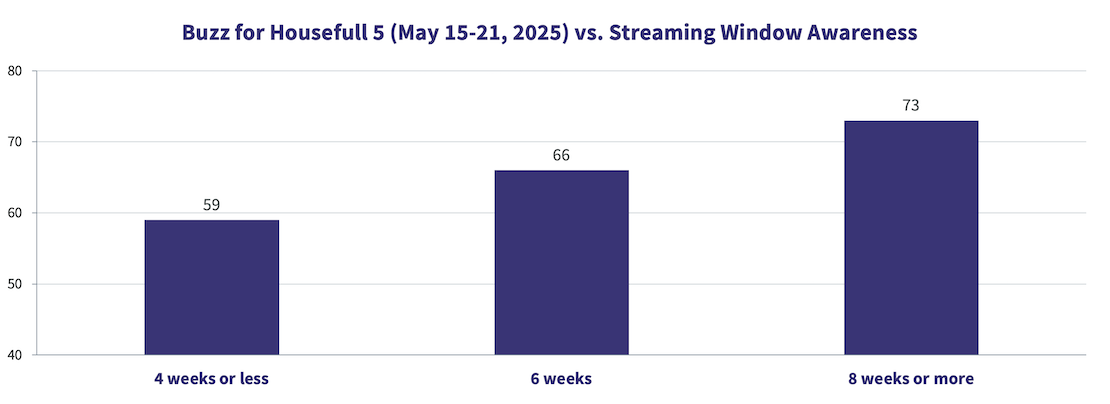

At the time of publishing this report, Housefull 5, scheduled to release on June 6, 2025, is tracking at a Buzz of 67% over the last one week. How does this Buzz vary based on the perceived gap between theatrical and OTT release? The chart below has the answer.

The Buzz for Housefull 5 increases significantly from 59% among those who perceive the gap to be four weeks or less, to 73% among those who perceive the gap to be eight weeks or more. In other words, the film has lesser talk value among audiences who believe Hindi theatrical films come within a month on OTT, compared to those who believe the gap is longer. A similar trend is seen in the Buzz for Sitaare Zameen Par, in the week after its trailer release.

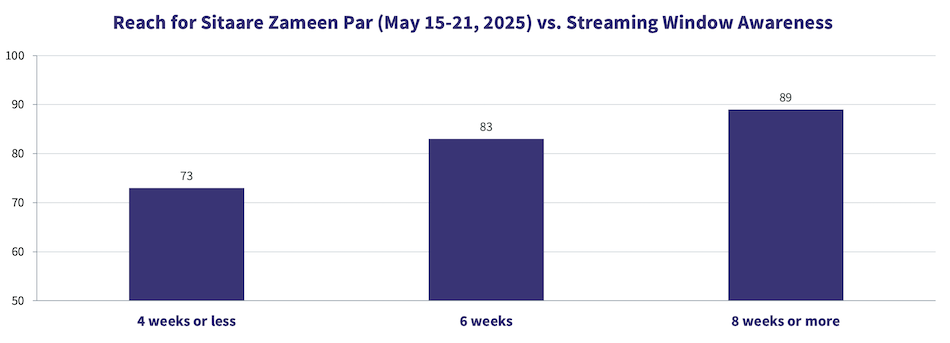

The second OCX parameter, Reach, refers to the awareness of the films, i.e., % audience who have heard the name of the film. Reach captures how wide the film's campaign has managed to penetrate among theatre-goers. Being an established franchise over four films, Housefull 5 is tracking at 97% Reach. Hence, no significant difference is seen in its Reach across segments based on perceived theatrical-to-OTT window. The chart below depicts the Reach for Sitaare Zameen Par over the last week, in the three segments based on the perceived gap.

Like seen with Buzz, those who believe films are released on OTT eight weeks (or later) after their theatrical release have higher Reach for the film, compared to those who perceive the window to be shorter. It can be inferred that audiences with a perception of shorter window are seeking less information related to new releases, and hence, are more likely to miss seeing a trailer, a poster or news coverage related to upcoming films, compared to audiences who with a perception of a longer window. In effect, the perception of a short window is creating less engagement with new movie campaigns, which is reflective in both the Buzz and the Reach examples above.

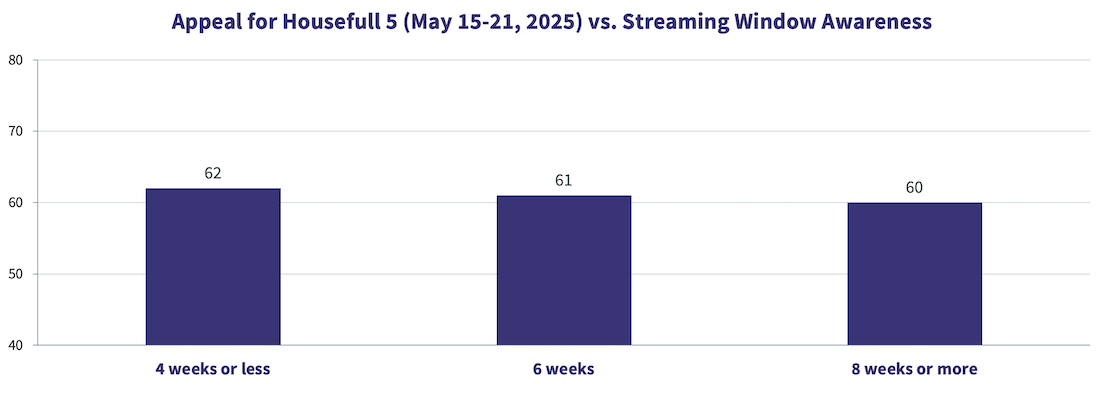

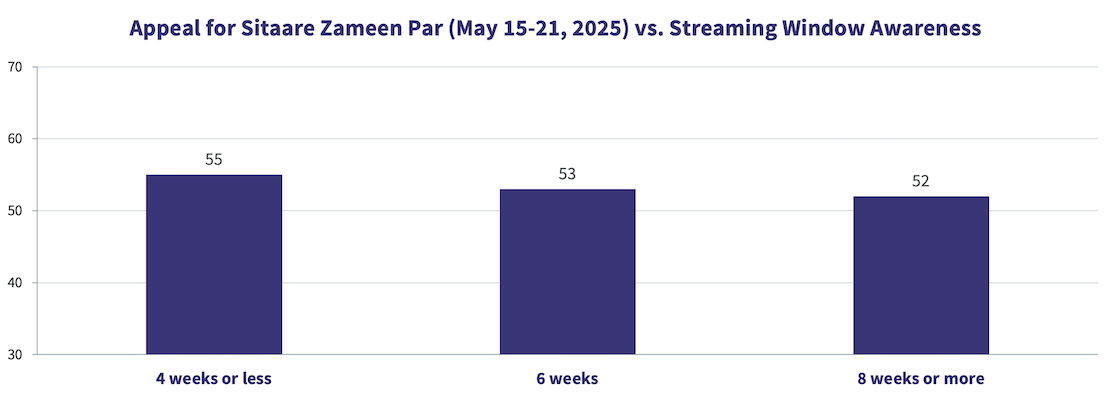

The third OCX parameter, Appeal, is a metric that reports % audience who have a definitive intention to watch the film in a theatre, among those aware of the film. Appeal is a strong indicator of the creative strength of the campaign, i.e., the collective pull of the film’s cast, theme, genre, franchise, music and other such aspects, as communicated via the various assets in the campaign.

Based on what we have seen above with Buzz and Reach, one could expect the Appeal to be higher among audiences who perceive the theatrical-to-OTT window to be longer. However, as the examples of both Housefull 5 and Sitaare Zameen Par below reveal, that is not the case!

There is no significant (or even directional) increase in Appeal based on the perceived theatrical-to-OTT window. Effectively, this means that audience's decision to watch a film in theatre is NOT based on their perceived awareness of how soon the film is going to become available on OTT post its theatrical release. It's the trailer, and other drivers such as the franchise, starcast, music, etc., which drive the Appeal for the campaign, and theatrical window perceptions have no role in influencing it.

Summary & Implications

The analysis above suggests that Hindi film audiences are not "deciding" to watch (or not watch) a film based on their perception of the gap between theatrical or OTT release of Hindi films. However, at a subconscious level, a shorter perceived gap can create less engagement with marketing campaigns of new films, which, in turn, can impact their ticket purchase behaviour for the film. If we run the FBO model for Housefull 5 on the three audience segments above, the FBO increases by a paltry 1.5 Cr (on a 25+ Cr base) as we move from a perceived window of less than four weeks, to that of more than eight weeks.

Hence, while it will be useful for the Hindi film industry to find a way of communicate to their target audiences that Hindi films do not come on OTT as early as 3-6 weeks post theatrical release, any change in streaming windows, unless fundamental in nature, is unlikely to boost the box office potential of new Hindi films by more than 5-10%. By fundamental change, we mean something as significant as 26 or 52 weeks, which is impractical from a business model standpoint, the way things stand today.

Urban romcoms: The Delhi NCR story

An analysis of why Delhi NCR contributes disproportionately to the box office of urban Hindi romcoms

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

The Ormax Box Office Report: 2025

Powered by Hindi cinema’s strong comeback, 2025 became the biggest year ever at the Indian box office, with gross collections of ₹13,395 Cr, even as footfalls stayed flat

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy