It’s raining shows (and films) in the streaming category in India. Since the start of 2020, a whopping 188 online shows (web-series) and 88 direct-to-OTT films have been launched, with a promotional campaign backing them, in the Hindi language alone. These numbers do not include original content being created for YouTube, or for a long list of niche apps operating in a market that’s trying to segment itself even as it grows at a more-than-healthy rate.

The numbers above translate into a weekly average of 2.6 shows and 1.2 films. In simple terms, four new Hindi language properties are being launched every week on mainstream platforms in India, not counting YouTube. The equivalent number for Hindi theatrical films (that released in at least 150 screens) in 2018 & 2019, the two full calendar years pre-pandemic, is 187 (over 104 weeks, compared to 73 weeks considered for the streaming numbers), i.e., an average of 1.8 per week, which is less than half the streaming average above. The Hindi GEC average for the last decade is just 1.2 shows per week.

With so much content being churned out, clutter is an obvious fallout. Add the vast list of International content, which the category continues to rely upon, to this mix, and the clutter levels go up further.

These numbers put India’s OTT growth story in good perspective. Any category in which the consumer is spoilt for choices is likely to prosper, in the short run anyway. The regional story in the Indian streaming space has not even started to script itself yet. Imagine if we had 3-4 dedicated apps for each major language, churning out shows and films at the rate of 2-3 per week per language. The streaming content ecosystem in India alone could potentially be producing 3X more content in a year than what the entire Indian video entertainment market produced in 2018.

But if you flip the perspective and view the same story from the consumer side, the picture isn’t so rosy. The chart that follows forms the crux of this article, and I must explain it well.

In our tracking work, we measure Appeal of new content across various domains. Appeal is a simple but powerful measure, defined as % aware audience who are likely to watch a piece of content, because they liked its campaign elements, such as the trailer, the cast, the genre, the music, the plot, etc. An Appeal of 60% implies that 60% of those aware of the show or the film expressed an active interest in watching it, while the remaining 40% were unsure or not interested at all. Since Appeal is measured on the aware-audience base, it’s a parameter that allows niche properties to be compared to the more big-ticket ones. For example, a film’s campaign may have reached only half the audience compared to another film’s campaign, but the former may actually have higher Appeal because its creatives are more compelling.

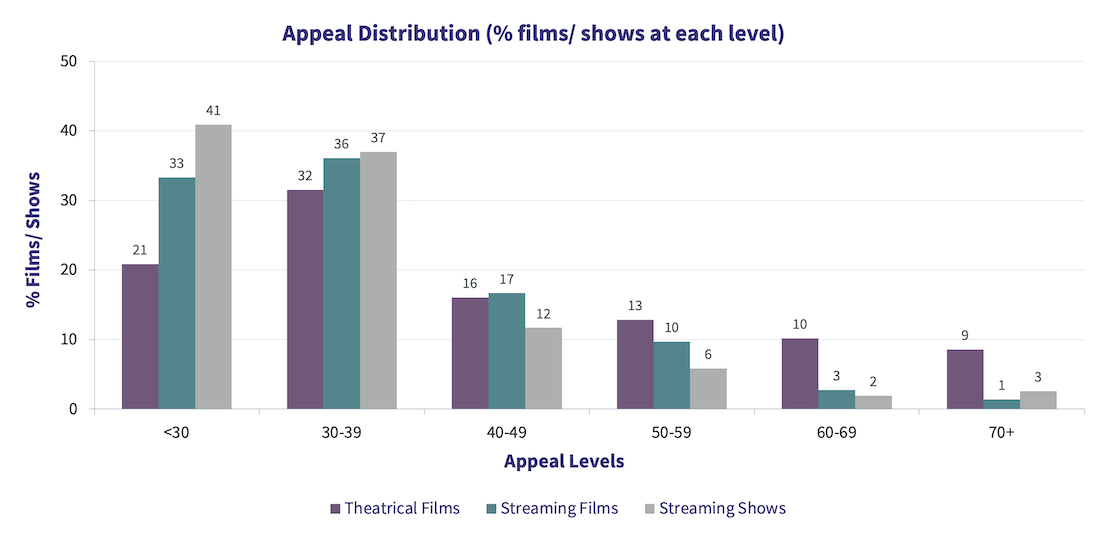

The purple bars in the chart below capture the Appeal (week of release) distribution of theatrical films released in India in 2018-19, measured via Ormax Cinematix. 21% films had an Appeal less than 30, 32% films had an Appeal in the 30-39 range, and so on, with 19% films at an Appeal of 60% of more, of which 9% were at 70% or more.

The green and the grey bars are for the streaming category, from January 2020 till date, measured via Ormax Stream Track. The green bars capture the Appeal distribution for the 88 direct-to-OTT Hindi films mentioned above, while the grey bars represent the 188 Hindi streaming shows. Since Appeal for streaming shows and films often picks up post launch, the week in which the Appeal peaked for that property (typically, it’s the week of launch or the week after for many properties) has been considered.

The difference is visually evident. 78% of streaming shows failed to amass an Appeal of even 40, which translates into a campaign verdict of “Rejection” in our parlance. This proportion is lower at 69% for streaming films, but the difference is largely attributable to theatrical films making it to streaming because of the pandemic. In contrast, the proportion is significantly healthier, at just 53%, for theatrical films.

At the right end of the chart, the story looks even more alarming. Only 11% streaming shows and 15% streaming films crossed an Appeal of even 50, compared to 32% theatrical films.

The verdict is clear: A large majority of streaming campaigns are just not delivering the goods. Whether it is the content itself, or the way it’s packaged or marketed, is a more complex topic for another day. But the numbers here reveal that only one out of eight Hindi launches on major streaming platforms in India since the start of 2020 gained any traction at all.

I must cover two valid counters to this inference before drawing any conclusions. The first counter can be about subscriber bases of various platforms creating fragmentation. If one doesn’t subscribe to a particular platform, why would one have positive Appeal for a show on it anyway? This is partly handled in the definition itself, as Appeal is a measure on the aware audience base, and non-subscribers are generally less aware of new launches than subscribers. And if the campaign indeed reached non-subscribers and made them aware, it would be with the intention to make them subscribe to the platform (especially given the rapid growth being witnessed during the pandemic), making Appeal among non-subscribers a relevant metric too. Not to mention that many audience continue to watch via pirated means, and subscription is not a pre-condition towards a positive intention to watch anyway.

The second counter can be about the starcast factor. A few theatrical films manage to amass Appeal on the strength of their lead star(s), even with mediocre trailers at times. It can be argued that since streaming platforms don’t have this factor working for them, they will find it harder to match the Appeal of theatrical films. This line of argument is over-simplistic, because like streaming doesn’t have the starcast factor working for it, theatrical category has its disadvantages too, none less than the ticket price and other expenses associated with a visit to the theatre. A trip to a multiplex for a family of four in a metro city is more expensive than annual subscriptions of all OTT platforms in India, barring Netflix, put together.

No matter how one looks at the data, the story that emerges is clear: In its growth phase in India, the streaming originals ecosystem has been more aligned to a quantity mindset than a success mindset. The longtail itself is not unusual. But it’s too lopsidedly-long for comfort. The strike rate of campaigns (and of the shows and the films they promote) is so low you can even conclude that the category is simply banking on the law of averages: Make a dozen shows, and something will stick, somehow.

A quantity mindset may have served the category well in its crucial early-growth years (the streaming originals market in India took off only in 2019). But as it enters its consolidation phase, where it has to look beyond the early adopters, quality is bound to come into play.

It’s good to spoil the consumer for choices. But too much choice, with too little that holds appeal, can disenchant the consumer too. And robust, sustainable growth almost never comes when the consumer is disenchanted.

If I were a streaming executive managing original content in India, I’d be closely tracking how the chart above looks for the second half of 2021. And if it doesn’t look any healthier than it does now, I’d be worried about how 2022 & 2023 are likely to shape up.

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

Product launch: Ormax StreamView

Our new weekly tracker is designed to answer a simple, high-stakes question for the Indian media and advertising ecosystem: “What is India watching on OTT?”

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy