By Our Insights Desk

Affluence is one of the most powerful, yet poorly measured, influencers of media and entertainment (M&E) consumption in India. While the country’s economic diversity is widely acknowledged, most industry frameworks rely on household-based income proxies, which do not reflect how individuals actually discover, consume, and pay for content. Traditional frameworks such as SEC or NCCS define affluence using ownership of basic household assets, many of which have little relation to media consumption. More importantly, they treat affluence as a household attribute, whereas media consumption is shaped as much by social and psychographic factors as by household economics. To address this need gap, we have introduced Ormax Media Affluence (OMA), a new audience classification system designed specifically to measure affluence for the media & entertainment sector in India.

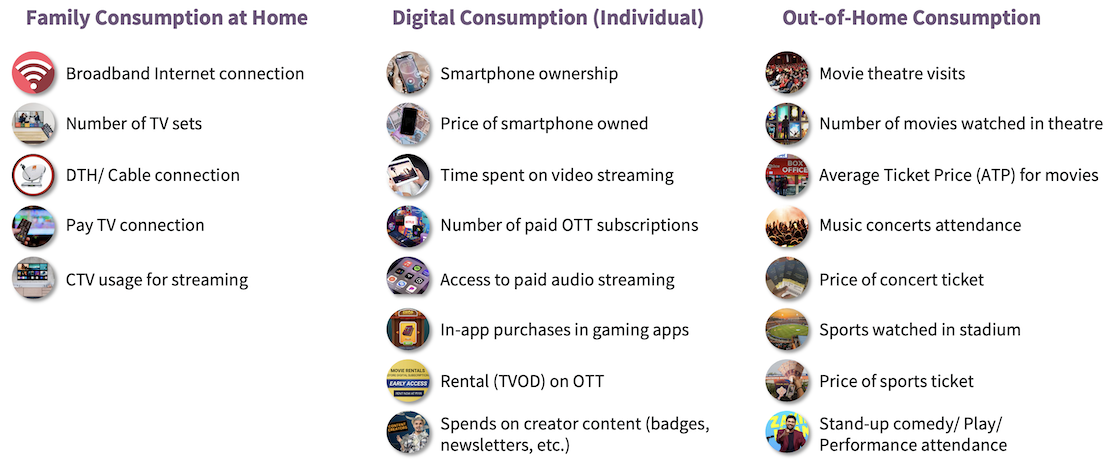

OMA is a scoring system built on 21 carefully-selected parameters (see chart below) spanning three broad consumption domains: family consumption at home, individual digital consumption, and out-of-home entertainment. These parameters go beyond simple access and frequency. They incorporate the monetary value of consumption, such as the price of smartphones owned, number of paid OTT subscriptions, rental spends on OTT, movie ticket prices, and spends on concerts, sports, live performances, etc. The result is an affluence score that is directly linked to an individual's propensity to spend both time and money on products and services in the M&E sector.

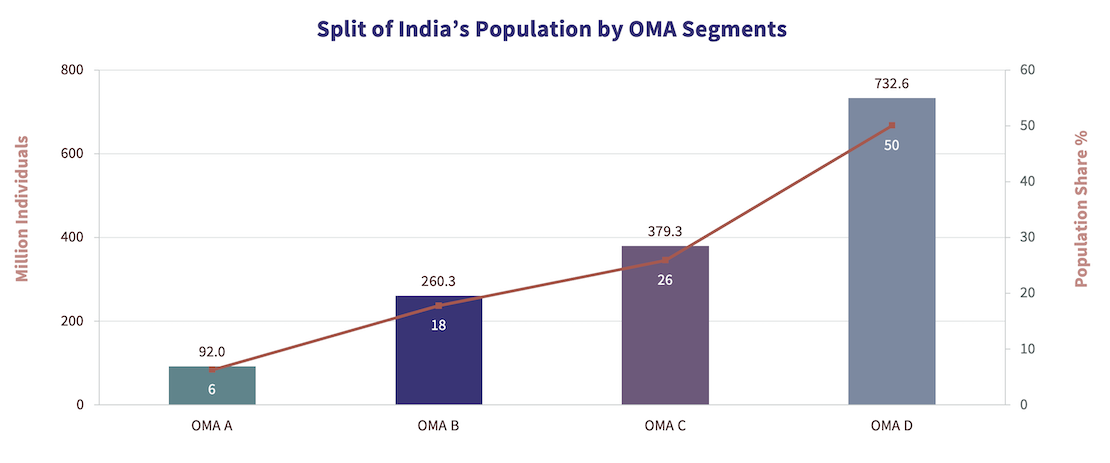

Based on a cumulative score across the 21 parameters, audiences are classified into one of four segments: OMA A, B, C or D. This structure allows the industry to move past generic socio-economic labels, and instead work with a media-relevant hierarchy of affluence. The chart below highlights the current composition of India’s population by OMA segments.

For the media industry, OMA enables more precise audience-led decision-making. Platforms can more accurately size and prioritize user cohorts, content owners can assess the revenue potential of content and formats, and marketers can align media planning and targeting with actual spending propensity rather than broad socio-economic proxies. By anchoring affluence in observed media behavior and spend, OMA improves the reliability of audience segmentation across content strategy, monetization, and distribution decisions.

OMA was introduced in The Ormax OTT Audience Report: 2025. Starting this year, we will integrate OMA across our research and analytics products, enabling sharper, more actionable insights by embedding media-led affluence as a core lens in audience understanding and decision-making.

For more details, download this explainer on Ormax Media Affluence (OMA).

Ormax Cinematix's FBO: Accuracy update (December 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major December 2025 releases vis-à-vis their actual box-office openings

The India Box Office Report: November 2025

November 2025 was an underwhelming month at the India Box Office, recording only ₹587 Cr in gross collections. However, the year stays on course to become the highest-grossing year of all time

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy